Resume Worded | Career Strategy

14 underwriter cover letters.

Approved by real hiring managers, these Underwriter cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Underwriter

- Senior Underwriter

- Associate Underwriter

- Junior Underwriter

- Underwriting Assistant

- Alternative introductions for your cover letter

- Underwriter resume examples

Underwriter Cover Letter Example

Why this cover letter works in 2024, reduced claim expenses.

Highlighting a specific accomplishment, like reducing claim expenses by 20%, shows the candidate's ability to drive results and provides a clear example of their capabilities. This is a strong way to showcase your value to the potential employer.

New Product Line Success

By outlining the successful launch of a new insurance product line, the candidate demonstrates their ability to lead a team, develop innovative solutions, and contribute to business growth. This shows that they are not only a results-driven individual but also a team player.

Aligning Personal Values with the Company's Mission

When you mention how the company's mission aligns with your own career objectives, you're showing the hiring manager that you've done your homework. You're not just looking for any job; you're interested in this specific role because it aligns with your personal mission. This demonstrates a deeper level of commitment and potential longevity with the company.

Quantify Your Achievements

When you explain that you led a project that reduced claim processing times by 30%, you're showing, not just telling, the value you've brought to your past employers. It's not only impressive but it also gives me a tangible idea of the impact you made. It's important to do this as much as you can.

Show Your Direct Impact

You mentioned integrating a new risk assessment tool that improved accuracy in premium calculations by 15%. You're not just stating that you participated in a project, you're highlighting the direct positive impact of your work. This is more compelling than just mentioning your duties or tasks.

Express Your Alignment with Company Values

When you express excitement about the role and the company's values, it shows you've done your homework and you truly understand what the company stands for. It also shows how passionate you are about contributing to those values. It's great to see this type of enthusiasm and alignment.

Communicate Your Long-Term Vision

Your vision of contributing to a future where insurance is more accessible, understandable, and humane aligns with the company's vision. This demonstrates you're not only committed to the role, but also to the company's long-term mission.

End On An Inviting Note

Your closing statement, thanking the hiring team for considering your application, and expressing excitement about the opportunity, keeps the door open for further discussion and shows your positive attitude. It's a great way to wrap up your cover letter.

Connect personal interest to career choice

Discussing your early interest in risk assessment shows you have a genuine passion for underwriting. This makes you more memorable to me.

Demonstrate experience with concrete examples

Talking about your role and highlighting a specific achievement helps me understand the level of your capabilities and your impact on your current company.

Express eagerness to apply specific skills

When you mention your keen eye for detail and strong work ethic, it reassures me that you're ready to tackle the responsibilities of an underwriter at our company.

Show interest in a growing field

By expressing a desire to specialize in cyber liability insurance, you align yourself with future industry needs, demonstrating foresight and ambition.

Extend a warm invitation for further discussion

Concluding with thanks and an openness to talk more about how you can contribute to the team feels polite and professional. It makes me want to invite you for an interview.

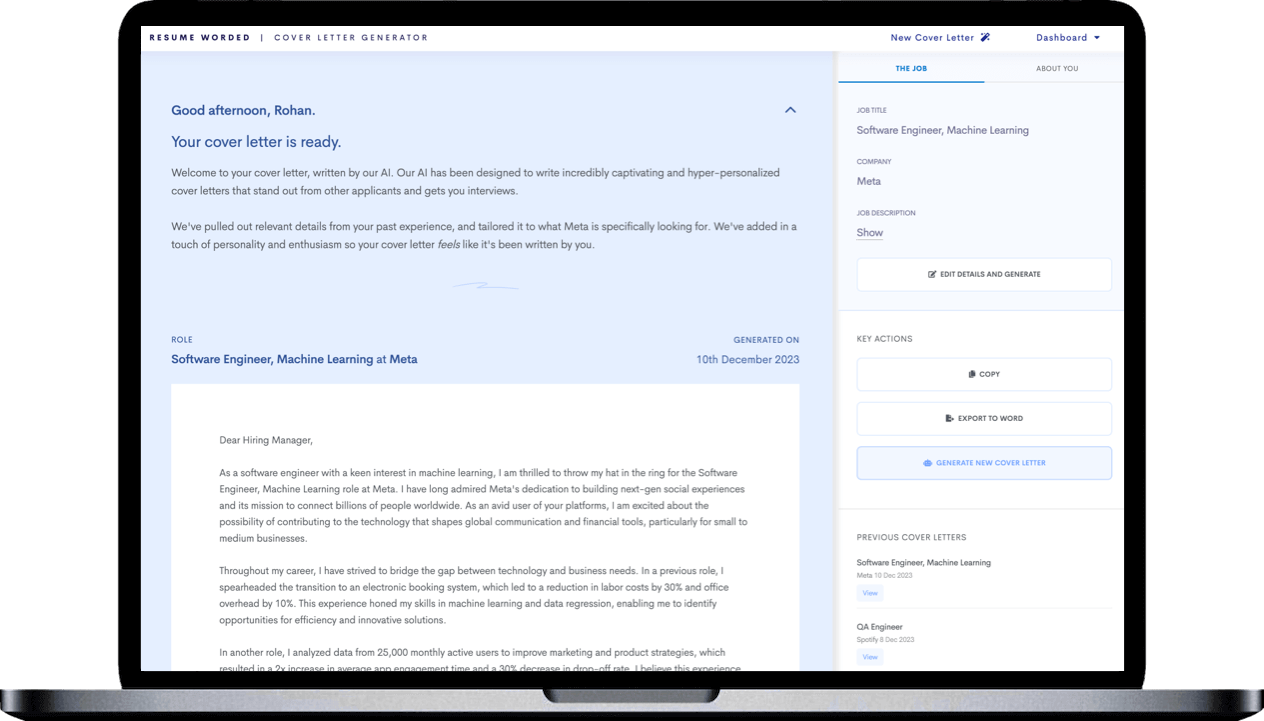

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Express genuine interest

Starting your cover letter by stating your long-standing fascination with underwriting and how it led you to apply to a well-respected company demonstrates genuine interest and passion for your career choice.

Showcase relevant experience

Mentioning your internship experience and specific achievements, like identifying a critical discrepancy, proves you have hands-on experience and can make meaningful contributions even at an early stage in your career.

Demonstrate problem-solving skills

Developing a risk assessment model that improved efficiency showcases your innovative thinking and problem-solving skills, which are crucial for an underwriter.

Emphasize your drive for growth

Highlighting your attraction to the company's reputation for nurturing talent shows you're not just looking for any job but a place where you can grow and develop professionally.

Convey your enthusiasm to contribute

Ending your cover letter with a thank you and an expression of eagerness to discuss how you can contribute to the team shows politeness and assertiveness, traits valuable in any professional setting.

Connect your passion to your career path

A personal story about discovering your career interest can make your application memorable and shows you're not just looking for any job, but you're passionate about this specific role.

Highlight your achievements with numbers

Adding specific outcomes and percentages to your previous work gives a clear picture of your impact. This approach is persuasive because it provides concrete evidence of your success and capabilities.

Show how you fit the underwriter team

By linking your skills and experience to the potential contributions you can make at Allstate, you're helping the hiring manager envision you in the role. It's effective to show you’ve researched and understand what they need.

Balance risk and customer needs

Understanding the core of underwriting work—balancing risk and customer satisfaction—is key. By stating this belief, you align with the company’s goals and demonstrate a deep understanding of the job's challenges and rewards.

Be polite and look forward

Ending your letter on a grateful note and expressing eagerness about the possibility of discussing your role further is courteous and shows enthusiasm for the opportunity.

Senior Underwriter Cover Letter Example

Quantifiable achievements.

Showing clear, quantifiable results like reducing application turnaround times by 30% is a direct way of demonstrating your potential impact as an underwriter. It's not just about stating what you did, but also showing the measurable outcomes of your actions. This goes a long way in proving your capabilities and the value you can bring to the table.

Highlight Your Leadership Skills

Describing how you led a team that improved efficiency and reduced costs provides solid evidence of your leadership skills. It also suggests that you are results-oriented, which is a trait highly valued in any role, especially in a senior underwriting position.

Reveal Your Team Development Skills

By mentioning the development of a comprehensive training program for new underwriters, you're demonstrating your commitment to team development and growth, a trait highly valued in senior-level roles. This also shows that you can produce tangible improvements in performance.

Show Enthusiasm for Innovation

Your excitement about the role at Allstate and how the company uses data and technology is a clear indication that you value innovation and are ready to perform in a forward-thinking environment. This shows that you appreciate the company's direction and are eager to contribute to its evolution.

Express Interest in Company's Unique Practices

Expressing interest in how Allstate uses advanced analytics for underwriting decisions shows you're informed about the company's unique practices and you're keen to contribute your expertise. It also demonstrates your understanding of the evolving nature of the industry.

Show Appreciation and Openness to Discussion

Thanking the hiring manager for considering your application and expressing openness to discuss your expertise further sets a pleasant tone. This shows you're appreciative of their time and eager to continue the conversation.

Show your underwriting expertise

Talking about your long experience and deep knowledge in underwriting, especially in a specific area like environmental risks, shows you are not just any candidate but one with valuable expertise.

Highlight your achievements

By mentioning your management of a large portfolio and your role in reducing losses, you demonstrate your direct impact on the company's success, a key trait for a senior underwriter.

Mentorship matters

Sharing your experience in mentoring and developing training programs for junior underwriters emphasizes your leadership skills and dedication to the growth of the industry.

Align with company values

Expressing your draw to the company’s commitment to sustainability and environmental risks not only shows you’ve done your homework but also that your personal and professional values align with theirs.

State your eagerness

Ending with a statement of eagerness to bring your skills and passion to the team is a strong closing. It reiterates your interest and confidence in your ability to contribute significantly.

Express excitement for the senior underwriter role

Sharing your enthusiasm for the position and the company sets a positive tone for your application.

Highlight a unique achievement

Discussing a specific success story demonstrates your capability to handle challenges creatively and effectively.

Show leadership and impact

Mentioning your mentoring of junior staff and the positive outcomes of your training initiatives showcases your leadership skills and your contribution to team improvement.

Convey your contribution to the team’s success

Expressing your desire to bring your expertise to the company indicates that you are forward-thinking and focused on adding value.

Close with a professional thank-you

Ending your letter by thanking the employer and expressing eagerness to discuss your application further is respectful and shows good manners.

Share meaningful experiences

Telling a story of a defining moment in your career can instantly grab attention. It not only illustrates your experience but also your capability to handle complex situations, crucial for a senior underwriter role.

Demonstrate leadership and results

Mentioning your management of a significant portfolio and your success in achieving a low loss ratio showcases your leadership skills and your effectiveness in driving positive outcomes, both critical qualities for a senior position.

Emphasize relationship building

Stressing the importance of building strong relationships in your field indicates you value teamwork and collaboration. For senior roles, the ability to maintain good relationships is often as important as technical skills.

Express eagerness to contribute

Showing your enthusiasm for bringing your approach and skills to a new company suggests you're not just looking for any job, but you're interested in making a real impact at Liberty Mutual.

Thank the reader professionally

Appreciation for the hiring manager’s time and consideration is a polite and professional way to close your letter, leaving a positive impression.

Associate Underwriter Cover Letter Example

Share a defining moment.

Recalling your first exposure to underwriting during an internship shows me the origin of your interest and helps me understand your commitment to this career path.

Highlight education and practical experience

Mentioning your degree and internship experience gives me confidence in your foundational knowledge and hands-on skills in underwriting.

Assure attention to detail

By emphasizing your diligence and a specific instance where it prevented a financial mistake, you make a strong case for why you'd be a reliable asset to the team.

Express enthusiasm for innovation

Your interest in the company’s innovation efforts, especially in insurtech, tells me you're not just looking for any job but a role where you can contribute to meaningful progress.

Convey a desire for growth and learning

Ending on a note of eagerness to join and grow with the company suggests you’re looking for a long-term opportunity where you can invest your efforts and evolve.

Junior Underwriter Cover Letter Example

Show your passion for underwriting.

Talking about your degree and your eagerness to start your career highlights your enthusiasm for the role and the industry.

Demonstrate practical experience

Giving an example of a project where you reduced risk shows you can apply what you've learned in a real-world scenario.

Align with the company's values

Mentioning your interest in the company’s use of technology indicates that you've done your research and see yourself fitting into their culture.

Confidence in your abilities

Stating your strengths clearly shows that you understand the value you could bring to the team.

Express gratitude and openness

Thanking the employer for considering your application and expressing interest in further discussion are polite and professional closing remarks.

Underwriting Assistant Cover Letter Example

Talking about your genuine interest in how insurance companies use data shows that you're not just looking for any job, but you're specifically interested in the underwriting field. This can make you more memorable to a hiring manager.

Detail your relevant experience

Mentioning specific tasks you've handled, like analyzing risk data and preparing policy documents, demonstrates that you have hands-on experience that is directly relevant to the role of an underwriting assistant. It's good to hear about your active involvement, rather than just your theoretical knowledge.

Express admiration for the company

When you express respect for the company's reputation in underwriting and risk management, it shows that you've done your homework and are genuinely interested in contributing to their team. It creates a positive impression that you're applying because you share similar values and goals.

Highlight eagerness to learn and contribute

Stating your excitement to learn from experienced underwriters and to contribute to the company's success indicates a proactive and growth-oriented mindset, which is highly valued in candidates for underwriting assistant roles.

Close with gratitude

Ending your cover letter by thanking the hiring manager for considering your application is polite and shows good professional etiquette. It leaves a positive last impression, which is important in any job application process.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Underwriter Roles

- Assistant Underwriter Cover Letter Guide

- Commercial Underwriter Cover Letter Guide

- Credit Underwriter Cover Letter Guide

- Loan Underwriter Cover Letter Guide

- Underwriter Cover Letter Guide

Other Legal Cover Letters

- Attorney Cover Letter Guide

- Contract Specialist Cover Letter Guide

- Lawyer Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Insurance Underwriter Cover Letter: Sample & Guide (Entry Level & Senior Jobs)

Create a standout insurance underwriter cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Finding the right insurance underwriter position requires a top-notch cover letter that highlights your skills and experience. Whether you're an experienced professional or just starting in the field, our comprehensive guide will help you craft a strong cover letter that will catch the attention of hiring managers. From formatting to content, we've got you covered with tips and samples to help you land your next insurance underwriter job.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- Why you should use a cover letter template

Related Cover Letter Examples

- Loan Officer Cover Letter Sample

- Reconciliation Analyst Cover Letter Sample

- Financial Aid Officer Cover Letter Sample

- Hedge Fund Accountant Cover Letter Sample

- Financial Risk Analyst Cover Letter Sample

- Senior Staff Accountant Cover Letter Sample

- Chief Investment Officer Cover Letter Sample

- Assistant Portfolio Manager Cover Letter Sample

- Accounting Assistant Cover Letter Sample

- Inventory Analyst Cover Letter Sample

- Finance Consultant Cover Letter Sample

- Accounting Auditor Cover Letter Sample

- Accounting Analyst Cover Letter Sample

- Financial Services Representative Cover Letter Sample

- Loan Closer Cover Letter Sample

- Commercial Analyst Cover Letter Sample

- Management Accountant Cover Letter Sample

- Investment Analyst Cover Letter Sample

- Statistical Analyst Cover Letter Sample

- Project Accountant Cover Letter Sample

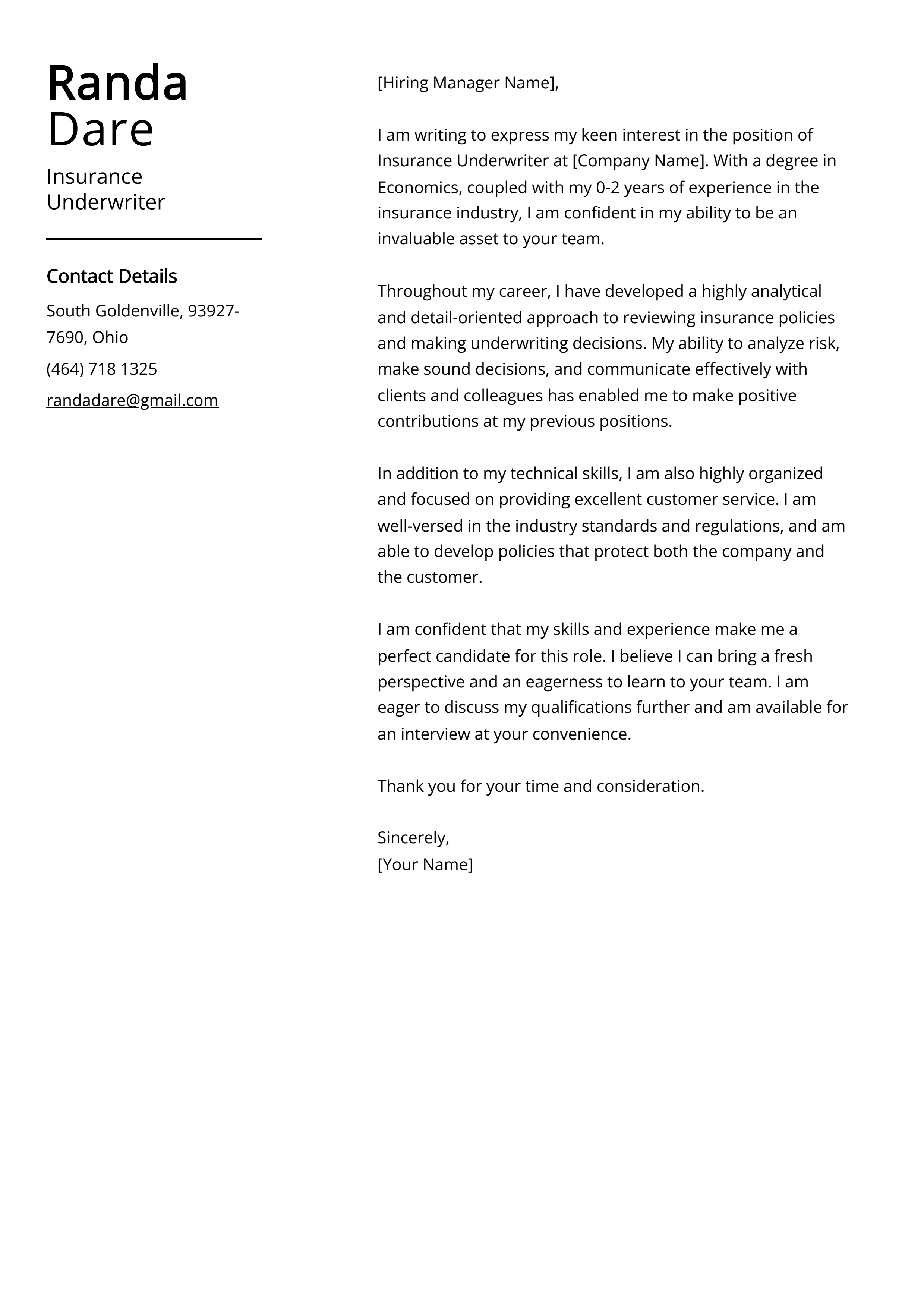

Insurance Underwriter Cover Letter Sample

Dear Hiring Manager,

I am writing to express my interest in the Insurance Underwriter position at your company. With a solid background in underwriting and a proven track record of accurately assessing risk and determining appropriate coverage, I am confident in my ability to contribute to your team and help achieve your company's goals.

In my previous role as an Insurance Underwriter, I developed and maintained strong relationships with insurance agents and brokers, while also effectively managing a large volume of new and renewal business. I have a comprehensive understanding of insurance policies, regulations, and industry standards, which allows me to make informed decisions and provide valuable insights to clients and colleagues alike.

With a keen eye for detail and a strong analytical mindset, I am accustomed to evaluating complex and diverse risks across various industries. I am skilled at using underwriting software to assess potential risks and determine coverage eligibility, while also ensuring compliance with company underwriting guidelines and state regulations.

I am an effective communicator and collaborator, and I thrive in a fast-paced and dynamic work environment. I am always eager to learn and adapt to new technologies and industry trends, and I am committed to continuously improving my skills and knowledge in the insurance field.

I am confident that my experience, qualifications, and dedication make me a strong fit for the Insurance Underwriter position at your company. I am excited about the opportunity to bring my expertise and enthusiasm to your team, and I am looking forward to the possibility of contributing to the continued success of your company.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my background, skills, and goals align with the needs of your team. Please feel free to contact me at your earliest convenience to schedule an interview. I appreciate your time and consideration.

[Your Name]

Why Do you Need a Insurance Underwriter Cover Letter?

- Highlight your relevant experience: A cover letter allows you to showcase your specific experience and expertise in insurance underwriting that may not be fully captured in your resume. This is your chance to explain how your skills and background make you a strong candidate for the position.

- Personalize your application: A cover letter gives you the opportunity to address the hiring manager directly and show your genuine interest in the company and the specific job. It allows you to explain why you are interested in the position and how you can contribute to the company's success.

- Showcase your communication skills: Writing a well-crafted cover letter demonstrates your ability to communicate effectively, a crucial skill for an insurance underwriter. It allows you to convey your ideas clearly and concisely, which is highly valued in the industry.

- Stand out from the competition: A cover letter gives you the chance to differentiate yourself from other candidates. It allows you to explain why you are uniquely qualified for the position and makes a compelling case for why you should be considered for the role.

- Demonstrate your attention to detail: As an insurance underwriter, attention to detail is crucial in evaluating and assessing risks. A well-written cover letter showcases your ability to pay attention to the small details and communicate your thoughts precisely and accurately.

A Few Important Rules To Keep In Mind

- Address the hiring manager by name, if possible.

- Introduce yourself and express your interest in the Insurance Underwriter position.

- Highlight your relevant experience and skills in underwriting and risk assessment.

- Showcase your knowledge of insurance policies and regulations.

- Emphasize your ability to analyze complex data and make sound decisions.

- Explain how your work ethic and attention to detail make you a strong candidate for the position.

- Close the cover letter with a polite request for an interview and a thank you for considering your application.

- Use a professional tone and language throughout the letter.

- Proofread for any grammar or spelling errors before sending.

What's The Best Structure For Insurance Underwriter Cover Letters?

After creating an impressive Insurance Underwriter resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Insurance Underwriter cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Insurance Underwriter Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

I am writing to express my interest in the Insurance Underwriter position at your company. With a strong background in risk assessment, policy analysis, and underwriting, I am confident in my ability to contribute to your team and help maximize the company's profitability.

- Introduction: Begin by introducing yourself and stating the position you are applying for.

- Experience and Skills: Highlight your relevant experience and skills in risk assessment, policy analysis, and underwriting. Include specific examples of successful underwriting decisions and risk evaluations you have made.

- Knowledge of Industry: Discuss your knowledge of the insurance industry, including trends, regulations, and best practices. Demonstrating your understanding of the industry will showcase your ability to make informed underwriting decisions.

- Teamwork and Collaboration: Emphasize your ability to work effectively in a team environment, collaborating with colleagues, and communicating with stakeholders. Discuss any experience you have working with underwriting teams and other departments within the company.

- Conclusion: Summarize your interest in the position and express your enthusiasm for the opportunity to contribute to the company's success as an Insurance Underwriter.

Thank you for considering my application. I am looking forward to the possibility of contributing to your team and am available at your earliest convenience for an interview. I appreciate your time and consideration.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Insurance Underwriter Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not addressing the letter to a specific person or company

- Using a generic template without customizing it for the specific job and company

- Focusing too much on your own career goals and not enough on how you can benefit the company

- Including irrelevant or unnecessary information

- Not proofreading for spelling and grammar errors

- Being too formal or too casual in your tone

Key Takeaways For an Insurance Underwriter Cover Letter

- Strong attention to detail and analytical skills

- Excellent communication and negotiation skills

- Ability to assess risk and make data-driven decisions

- Experience in underwriting various types of insurance policies

- Ability to work independently and as part of a team

Underwriter Cover Letter Examples & Samples for 2024

Craft an exceptional Underwriter Cover Letter with our online builder. Explore professional example cover letter templates tailored for every level and specialty. Captivate employers with a refined, professional Cover Letter. Secure your dream job today!

Table of Contents

As an underwriter, your role is pivotal in assessing risk and making informed decisions that can significantly impact your organization’s bottom line. Crafting an effective cover letter is your first opportunity to showcase your analytical skills, attention to detail, and understanding of the insurance landscape. In this article, we will provide you with a comprehensive guide to writing a compelling cover letter tailored for an underwriter position. Whether you’re a seasoned professional or just starting out, our guide will equip you with essential tips and a real-world example to help you stand out in a competitive job market. Here’s what you can expect to learn:

- The key elements to include in your cover letter to grab the employer's attention

- How to tailor your letter to the specific job description and company culture

- Tips for highlighting relevant experience and skills that align with underwriting

- Strategies to demonstrate your analytical thinking and risk assessment abilities

- An example cover letter that illustrates effective writing techniques and formats

Prepare to dive deep into the art of cover letter writing, ensuring your application not only gets noticed but also leaves a lasting impression!

What does a Underwriter Cover Letter accomplish?

A cover letter for an Underwriter plays a crucial role in showcasing the candidate's qualifications and suitability for the position. It serves as an opportunity to highlight relevant skills, such as risk assessment and analytical abilities, while also conveying the candidate's understanding of the underwriting process and industry standards. The letter complements the resume by providing context and personal insights that can make a candidate stand out in a competitive job market. By effectively communicating their motivations and demonstrating how their experience aligns with the prospective employer's needs, applicants can significantly enhance their chances of landing an interview. For those looking to craft an exceptional letter, a cover letter guide can offer valuable tips, and using a cover letter builder can streamline the process, ensuring a professional presentation.

Key Components of a Underwriter Cover Letter

- Introduction and Purpose : Clearly state the position you are applying for and express your enthusiasm for the role. Mention how you learned about the job opening and briefly introduce your background in underwriting.

- Relevant Experience and Skills : Highlight your specific experience in underwriting, mentioning any relevant certifications or qualifications. Discuss key skills such as risk assessment, analytical abilities, and attention to detail that make you a strong candidate.

- Achievements and Contributions : Provide examples of past achievements that demonstrate your success in underwriting, such as improving approval rates, reducing risk exposure, or enhancing client relationships. Use quantifiable metrics where possible to illustrate your impact.

- Closing and Call to Action : Conclude by reiterating your interest in the position and expressing your desire for an interview. Thank the employer for considering your application and provide your contact information for follow-up.

For more guidance, check out cover letter examples and learn about the proper cover letter format .

How to Format a Underwriter Cover Letter

As an aspiring underwriter, crafting a compelling cover letter is essential to showcase your skills, experience, and passion for the role. Here are key points to consider when formatting your underwriter cover letter:

- Personalize Your Greeting : Address the hiring manager by name if possible to create a connection and show you've done your research.

- Start with a Strong Opening Statement : Begin with a captivating opening that highlights your enthusiasm for the position and the company.

- Mention Relevant Experience : Clearly outline your relevant work experience, focusing on specific underwriting roles or tasks you've performed.

- Highlight Key Skills : Emphasize essential skills such as risk assessment, analytical thinking, attention to detail, and financial acumen.

- Showcase Industry Knowledge : Demonstrate your understanding of the underwriting process, regulations, and market trends in the industry.

- Use Quantifiable Achievements : Include metrics or outcomes from previous positions, such as improved approval rates or reduced turnaround times.

- Express Commitment to Professional Development : Mention any certifications, courses, or training you've completed that align with underwriting practices.

- Include Soft Skills : Highlight interpersonal skills like communication and collaboration, which are critical when working with clients and team members.

- Conclude with a Call to Action : Express your eagerness to discuss your application further and indicate your desire for an interview.

- Professional Closing : End with a polite closing statement, thanking the reader for their time and consideration, followed by your signature.

Underwriter Entry-Level Cover Letter Example #1

I am writing to express my interest in the entry-level Underwriter position at [Company Name], as advertised on [Job Board/Company Website]. With a solid foundation in finance and risk assessment through my academic studies and internships, I am excited about the opportunity to contribute to your team and grow within the underwriting field.

During my time at [University Name], where I earned my degree in Finance, I developed a keen understanding of financial analysis, risk management, and the principles of insurance. My coursework included in-depth studies of underwriting practices, market analysis, and statistical methods, all of which have equipped me with a strong analytical framework. Additionally, I completed an internship at [Internship Company Name], where I assisted senior underwriters in evaluating insurance applications and assessing risk factors. This hands-on experience honed my ability to analyze data, interpret financial statements, and make informed recommendations.

Moreover, my internship allowed me to collaborate with cross-functional teams, enhancing my communication and teamwork skills. I successfully contributed to a project that streamlined the application review process, resulting in a 15% reduction in processing time. This experience not only reinforced my attention to detail but also taught me the importance of balancing thorough analysis with efficiency—a crucial aspect of underwriting.

I am particularly drawn to [Company Name] because of your commitment to innovation in the underwriting process and your reputation for fostering professional development. I am eager to bring my analytical skills, strong work ethic, and passion for the insurance industry to your team. I am confident that my proactive approach and willingness to learn will allow me to make a positive impact at [Company Name].

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the goals of your underwriting team. I am excited about the possibility of contributing to [Company Name] and am eager to learn from your experienced professionals.

Underwriter Mid-Level Cover Letter Example #2

I am writing to express my interest in the Underwriter position at [Company Name], as advertised on [where you found the job listing]. With over [X years] of experience in the insurance and underwriting fields, I have honed my skills in risk assessment, financial analysis, and customer relationship management, making me a strong candidate for this role.

In my previous position at [Previous Company Name], I successfully managed a diverse portfolio of clients, evaluating their insurance applications and determining appropriate coverage levels. My keen analytical skills allowed me to assess risk factors effectively, leading to a [specific achievement, e.g., 20% reduction in claims or improved approval turnaround time]. I utilized sophisticated underwriting software and maintained thorough documentation to ensure compliance with industry regulations while providing excellent customer service. My ability to communicate complex information clearly to clients and colleagues alike has fostered strong relationships and built trust, which I believe is essential in this industry.

Additionally, I have collaborated closely with sales and risk management teams to develop tailored insurance products that meet the unique needs of clients. This cross-functional experience has not only expanded my knowledge of market trends and customer preferences but has also enhanced my problem-solving abilities. I am adept at identifying potential issues early in the underwriting process and proactively addressing them to facilitate smooth transactions and enhance client satisfaction.

I am particularly drawn to [Company Name] because of its commitment to [specific company value or initiative, e.g., innovation, customer service, community involvement]. I believe that my proactive approach to underwriting and my dedication to continuous improvement align perfectly with your company’s goals. I am excited about the opportunity to contribute to your team and help drive continued growth and success.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team at [Company Name]. I am eager to bring my expertise to your organization and contribute to its ongoing success.

Underwriter Experienced Cover Letter Example #3

I am writing to express my interest in the Underwriter position at [Company Name], as advertised on [Job Board/Company Website]. With over [X years] of extensive experience in underwriting across various sectors, including [specific sectors, e.g., commercial, personal, mortgage], I am confident in my ability to contribute effectively to your team and support [Company Name] in achieving its goals.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of clients, conducting thorough risk assessments and developing tailored underwriting strategies. My ability to analyze complex financial documents and assess risk factors enabled me to make informed decisions that consistently aligned with company policies and risk appetite. I played a pivotal role in reducing the overall claims ratio by [specific percentage or outcome], demonstrating my commitment to maintaining high standards of accuracy and efficiency in the underwriting process.

I am particularly proud of my contributions to developing and implementing new underwriting guidelines that streamlined operations and improved turnaround times by [specific improvement metric]. By collaborating closely with cross-functional teams, I ensured that our underwriting practices not only met regulatory requirements but also enhanced customer satisfaction. My proactive approach and strong analytical skills have allowed me to identify emerging trends in the market, enabling my team to adapt strategies that mitigate potential risks effectively.

As an advocate for continuous professional development, I have pursued certifications such as [relevant certifications, e.g., Chartered Property Casualty Underwriter (CPCU), Associate in Commercial Underwriting (AU)], which have further honed my skills and knowledge in risk assessment and management. I am excited about the opportunity to bring this expertise to [Company Name] and contribute to your reputation for excellence in underwriting services.

I am eager to discuss how my experience and vision align with the goals of [Company Name]. Thank you for considering my application. I look forward to the opportunity to speak with you further about how I can contribute to your esteemed team.

Cover Letter Tips for Underwriter

When crafting a cover letter for an Underwriter position, it's essential to highlight both your analytical skills and your attention to detail, as these qualities are critical in assessing risk and making informed decisions. Begin with a strong opening that captures the reader's attention and clearly states your interest in the position. Make sure to tailor your cover letter to the specific job and company, demonstrating your understanding of their values and how your experience aligns with their needs. Use specific examples from your past work to illustrate your qualifications and achievements, and conclude with a confident closing that encourages further discussion about your application.

Cover Letter Tips for Underwriters:

- Tailor Your Letter: Customize your cover letter for each job application by incorporating the company's name and specifics about the role to show genuine interest.

- Highlight Relevant Experience: Focus on your previous underwriting experience, showcasing your ability to assess risk, analyze data, and make sound financial decisions.

- Showcase Analytical Skills: Use examples that demonstrate your analytical abilities, such as successful risk assessments or complex case evaluations.

- Emphasize Attention to Detail: Illustrate how your meticulous nature has led to fewer errors and improved decision-making processes in your previous roles.

- Include Industry Knowledge: Mention any relevant certifications, training, or continuing education that aligns with the underwriting field, such as CPCU or AINS designations.

- Use Metrics and Achievements: Quantify your accomplishments where possible, such as "improved underwriting turnaround time by 20%" to provide tangible evidence of your impact.

- Demonstrate Communication Skills: Highlight your ability to communicate complex information clearly, as this is essential when working with clients and team members.

- Conclude Strongly: End your cover letter with a persuasive closing statement that reiterates your enthusiasm for the role and invites the hiring manager to discuss your qualifications further.

How to Start a Underwriter Cover Letter

As you begin crafting your cover letter for an Underwriter position, it's essential to create a compelling introduction that captures the hiring manager's attention. Here are some effective examples to guide you:

I am excited to apply for the Underwriter position at [Company Name] as advertised on [Job Board]. With over five years of experience in risk assessment and financial analysis, I am eager to contribute my expertise to your team and help drive informed decision-making. Having successfully managed underwriting processes in both commercial and personal lines, I am thrilled to submit my application for the Underwriter role at [Company Name]. My background in evaluating risks and developing tailored insurance solutions aligns perfectly with your organization’s commitment to excellence. I am writing to express my interest in the Underwriter position at [Company Name]. With a strong foundation in actuarial science and a proven track record of reducing losses through strategic underwriting practices, I am well-prepared to contribute to your company’s success. As a detail-oriented underwriter with a passion for data-driven decision-making, I was excited to discover the opening at [Company Name]. My extensive experience in analyzing complex financial documents and collaborating with agents positions me as an ideal candidate for this role. I am eager to join [Company Name] as an Underwriter, where I can leverage my analytical skills and risk assessment experience. My commitment to delivering outstanding service and fostering strong relationships has been key to my success in previous underwriting positions.

How to Close a Underwriter Cover Letter

As you conclude your cover letter for an Underwriter position, it's essential to leave a lasting impression that reinforces your qualifications and enthusiasm for the role. Here are some effective examples of how to close your letter:

“I am excited about the opportunity to bring my extensive underwriting experience to your team and contribute to the continued success of your organization. Thank you for considering my application; I look forward to discussing how my skills align with your needs.”

“I appreciate your time in reviewing my application, and I am eager to discuss how my analytical skills and attention to detail can add value to your underwriting team. I hope to speak with you soon.”

“Thank you for the opportunity to apply for this position. I am enthusiastic about the possibility of leveraging my expertise in risk assessment to enhance your underwriting processes and help achieve your business goals.”

“I look forward to the possibility of discussing my application further and exploring how I can contribute to your team’s success with my background in underwriting and risk management. Thank you for your consideration.”

Common Mistakes to Avoid in a Underwriter Cover Letter

When applying for an underwriter position, your cover letter serves as your first impression to potential employers. It is essential to present a compelling and professional narrative that highlights your qualifications and aligns with the expectations of the role. However, many applicants make common mistakes that can detract from their application. To ensure your cover letter stands out for the right reasons, here are some pitfalls to avoid:

- Generic Salutation : Avoid using a vague greeting like "To Whom It May Concern." Instead, address the letter to a specific hiring manager or recruiter if possible.

- Lack of Personalization : Failing to customize your cover letter for the specific company and position can make it seem insincere. Research the company and mention specifics that relate to their values or projects.

- Repetition of the Resume : A cover letter should complement your resume, not merely repeat its content. Focus on elaborating on your skills and experiences that are particularly relevant to the underwriting role.

- Overly Complex Language : Using jargon or overly complicated language can confuse the reader. Keep your writing clear, concise, and straightforward.

- Ignoring the Job Description : Not aligning your skills and experiences with the job description can show a lack of attention to detail. Highlight how your qualifications meet the specific requirements of the underwriting position.

- Neglecting Professional Tone : A casual or overly informal tone can undermine your professionalism. Maintain a formal tone throughout the letter.

- Typos and Grammatical Errors : Spelling mistakes or grammatical errors can create a negative impression. Always proofread your letter multiple times and consider having someone else review it.

- Failing to Showcase Achievements : Simply listing duties without demonstrating accomplishments can weaken your case. Use quantifiable examples to illustrate your successes in previous underwriting roles.

- Weak Closing Statement : Ending your letter without a strong closing can leave a lasting negative impression. Reinforce your enthusiasm for the role and clearly state your desire for an interview.

- Ignoring Length Guidelines : A cover letter that is too long or too short can signal a lack of focus. Aim for one page, ensuring you convey your message effectively without unnecessary elaboration.

Key Takeaways for a Underwriter Cover Letter

In crafting an effective cover letter for an underwriter position, it's essential to highlight your analytical skills and attention to detail, as these are critical traits for success in this role. Begin by showcasing your relevant experience and any certifications that demonstrate your proficiency in risk assessment and financial analysis. Tailor your letter to the specific job description, emphasizing how your previous work has prepared you to make informed decisions that align with the company's objectives. This personalized approach not only captures the reader's attention but also establishes your genuine interest in the position.

Moreover, consider utilizing cover letter templates that can streamline the writing process and ensure a professional presentation. A well-structured cover letter can set you apart from other candidates, reflecting your organizational skills and commitment to the role. For those seeking a more personalized touch, a cover letter builder can provide guided assistance, helping you articulate your qualifications effectively while maintaining a polished format. By investing time in your cover letter, you significantly enhance your chances of making a lasting impression on potential employers.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.

Make a cover letter in minutes

Pick your template, fill in a few details, and our builder will do the rest.

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Reinsurance Underwriter Cover Letter Example

Writing a cover letter for a reinsurance underwriter position can be a challenging task. It can feel like you have to condense your entire professional history and qualifications into a single page. Fortunately, there are some methods you can use to make the task of writing a reinsurance underwriter cover letter easier. This guide will provide advice and an example of what to include in your cover letter so that you can craft an effective and professional application.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Reinsurance Underwriter Cover Letter Sample

Dear [Hiring Manager],

I am writing to express my interest in the position of Reinsurance Underwriter at [Company Name]. With a master’s degree in Statistical Risk Analysis and Financial Modeling, and five years of experience in the reinsurance industry, I am confident that I can bring a great deal of knowledge and expertise to the role.

One of my greatest strengths is my ability to identify and assess potential risks and develop strategies for mitigation. I am adept at analyzing reinsurance loss data to determine the most efficient and cost- effective reinsurance structures for clients. I am also experienced in developing reinsurance programs that meet regulatory requirements, as well as working collaboratively with other department stakeholders to ensure timely and accurate delivery of risk management solutions.

What sets me apart from other candidates is my passion for staying up to date with the industry’s evolving rules and regulations. I consistently review the latest updates to ensure that I am familiar with the latest trends and developments, enabling me to provide the most comprehensive advice to my clients.

I am an excellent communicator who is able to build strong relationships with clients and colleagues alike. I pride myself on my ability to explain complex concepts in an easy- to- understand manner, and I take great pleasure in delivering results that exceed expectations.

I am eager to join your team and put my experience and skills to use. I am confident I can be a great asset to [Company Name] and I look forward to discussing my qualifications further in an interview.

Sincerely, [Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Reinsurance Underwriter cover letter include?

A reinsurance underwriter cover letter should include three key things:

- A statement about your specific qualifications for the role. Your cover letter should outline your professional experience, qualifications and certifications that demonstrate your ability to be successful in the role of a reinsurance underwriter.

- An explanation of why you are the best fit for the position. Explain why you think you are uniquely qualified for the role and how your skills and experience make you the best candidate.

- An explanation of your enthusiasm for the position. Reinsurance underwriters must have a deep understanding of the industry, so include a detailed explanation of your interest in the industry and why you would make an ideal candidate.

Including these three elements in your cover letter will demonstrate that you are the ideal candidate for the reinsurance underwriter position and will give the hiring manager an insight into your background and motivation.

Reinsurance Underwriter Cover Letter Writing Tips

Cover letters are essential components of job applications. As a reinsurance underwriter, it is important to craft a compelling cover letter that highlights your skills, experience, and qualifications. Here are some tips to help you write an effective cover letter:

- Address the cover letter to the right person. Do your research to find the name of the hiring manager or personnel manager, if possible.

- Use an appropriate tone. Your cover letter should be professional and polished. Avoid using overly casual language or slang.

- Highlight your qualifications. Talk about the skills and experience you possess that are relevant to the job you are applying for.

- Provide examples. Show that you have the knowledge and experience to do the job by providing examples of your work.

- Discuss your goals. Talk about what you hope to accomplish in the role, and how you plan to use your skills to help the company.

- Be concise. Make sure your cover letter is no more than a page long, and focus on only the most important points.

- Proofread. Make sure your cover letter is free of grammar and spelling errors.

Following these tips can help you craft an impactful cover letter that will help you stand out from other applicants and increase your chances of getting an interview.

Common mistakes to avoid when writing Reinsurance Underwriter Cover letter

Writing a cover letter for a Reinsurance Underwriter position requires careful consideration and attention to detail. With the right amount of forethought and preparation, you can craft a cover letter that will demonstrate your qualifications to the hiring manager. However, there are some common mistakes that you should be aware of and avoid when writing your cover letter.

- Not Customizing Your Cover Letter: A generic cover letter is a sure- fire way to get your application overlooked. Take the time to customize your letter to reflect the specific qualifications of the position and how they match up with your experience.

- Ignoring the Job Description: When writing your cover letter, ensure that you are familiar with the job description and highlight the specific requirements that you meet.

- Not Highlighting Your Soft Skills: In addition to your technical qualifications, emphasize the interpersonal skills and qualities that make you stand out from the competition.

- Not Researching the Company: An effective cover letter should demonstrate your knowledge of the company and how your skills and experience align with its goals and objectives. Take some time to research the company and its industry to gain a better understanding of its mission and culture.

- Not Proofreading: Sloppy grammar and spelling errors can make your cover letter unprofessional and unpersuasive. Before submitting your letter, take the time to proofread it carefully to ensure accuracy and clarity.

By avoiding these common mistakes, you can craft a Reinsurance Underwriter cover letter that will impress the hiring manager and increase your chances of getting an interview.

Key takeaways

Writing a cover letter is an important step in the job search process. If you’re an aspiring Reinsurance Underwriter, you’ll want to make sure your cover letter stands out from the competition. Here are some key takeaways for writing an impressive Reinsurance Underwriter cover letter:

- Focus on your experience and qualifications: Showcase your experience and qualifications related to reinsurance underwriting. Highlight any certification or training you have completed, as well as any successful projects you have completed in the past.

- Utilize industry language: Familiarity with reinsurance underwriting terms and processes will help you stand out from the competition. Be sure to sprinkle in technical language that is specific to the industry.

- Showcase your accomplishments: Demonstrate your knowledge of the reinsurance industry through specific examples of successful projects you’ve completed.

- Expand on your skills and qualifications: Take the time to explain why you are the best candidate for the job. Expand on particular skills and qualifications that make you stand out from the competition.

- Stress the importance of your communication skills: Communication is a key part of any job, but especially when it comes to reinsurance underwriting. Make sure to emphasize your communication skills and your ability to work with clients and team members.

- Close the letter on a positive note: Make sure to end the letter by thanking the employer for the opportunity and expressing your enthusiasm for the role.

By following these key takeaways, you’ll be well on your way to writing an impressive cover letter for a reinsurance underwriter position. Good luck!

Frequently Asked Questions

1.how do i write a cover letter for an reinsurance underwriter job with no experience.

Writing a cover letter for an Reinsurance Underwriter job with no experience can be a challenge, as you may not have any specific experience or qualifications that are required for the role. However, it’s still important to provide a convincing cover letter that outlines your skills and abilities and why you would be a great fit for the role.

Start by introducing yourself and explain why you are interested in the role. Outline the knowledge and skills you have that are relevant to the role, such as strong communication and analytical skills, as well as your overall motivation and enthusiasm for the position. Showcase your strengths and accomplishments from any other jobs or experiences you have had, and make sure to emphasize any additional qualities that you think would make you a great fit for the Reinsurance Underwriter role.

2.How do I write a cover letter for an Reinsurance Underwriter job experience?

When writing a cover letter for a role as an Reinsurance Underwriter, focus on your experience and qualifications and how they make you a great fit for the position. Outline your experience in the insurance industry, such as any knowledge you have of the different types of insurance policies, and any previous underwriting or risk assessment roles you have had.

Highlight any strong analytical skills you have, such as good problem- solving and decision- making abilities, and your ability to assess risk. Point out any relevant qualifications or certifications you have, and mention any awards or recognition you may have received for your work.

Finally, make sure to emphasize your enthusiasm for the role, as well as your willingness to learn and grow in the role.

3.How can I highlight my accomplishments in Reinsurance Underwriter cover letter?

When highlighting your accomplishments in a Reinsurance Underwriter cover letter, make sure to focus on your experience and qualifications and how they make you a great fit for the position. Outline any successes or achievements you have had in your previous underwriting, risk assessment, and insurance roles.

Highlight any successful projects you have worked on, as well as any awards or recognition you may have received. Make sure to mention any certifications or qualifications that you possess and how these have helped you in your work.

Finally, emphasize your enthusiasm for the role and your willingness to learn and grow in the role.

4.What is a good cover letter for an Reinsurance Underwriter?

A good cover letter for an Reinsurance Underwriter should emphasize your skills and experience in the insurance industry, as well as any relevant qualifications or certifications you possess. Outline your analytical and problem- solving skills and emphasize any successes you have had in past roles.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

IMAGES

VIDEO

COMMENTS

Senior Insurance Underwriter Cover Letter Example. Dear Ms. Thompson, I am writing to express my strong interest in the Senior Insurance Underwriter position at Liberty Mutual. With over 8 years of experience in the insurance industry, I am drawn to Liberty Mutual's commitment to innovation and customer-centric approach.

Get interview-ready with tips from Indeed. Michael Atkins. 771-555-0199. [email protected] January 22, 2023 Dear hiring manager, I am writing to inquire further about your open position for an Underwriter at Dream Finances Co. and to express my excitement about the opportunity.

7 Underwriter Cover Letter Examples. Underwriters meticulously assess risk, balancing potential gains and losses to make informed decisions that protect their company's financial health. Similarly, your cover letter is your opportunity to demonstrate your ability to evaluate and manage risk, showcasing your analytical skills and attention to ...

Insurance Underwriters should include the following elements in their cover letter: 1. Contact Information: Start with your name, address, phone number, and email address at the top of the cover letter. 2. Salutation: Address the hiring manager by their name if it's known.

Underwriter Cover Letter Example. Dear Hiring Team, I'm reaching out to express my interest in the Underwriter position at Liberty Mutual. My journey into the world of insurance began unexpectedly during a college internship; I was fascinated by the blend of analytics, risk assessment, and personal interaction.

Format an Insurance Underwriter Cover Letter Get tips on how to structure and format your cover letter for maximum readability. Three different level cover letter examples Explore tailored examples for entry-level, mid-level, and senior positions to guide your writing. Common Mistakes to Avoid in an Insurance Underwriter Cover Letter

Insurance Underwriter Cover Letter Sample. Dear Hiring Manager, I am writing to express my interest in the Insurance Underwriter position at your company. With a solid background in underwriting and a proven track record of accurately assessing risk and determining appropriate coverage, I am confident in my ability to contribute to your team ...

Discover effective underwriter cover letter examples and samples to enhance your job application. Our comprehensive guide provides tips and templates to help you stand out in the competitive insurance industry. Perfect your cover letter and secure your dream underwriting position today!

I believe I can contribute to the professionalism of your underwriting team resulting in greater profitability for the company. I look forward to hearing from you at your earliest convenience. Thank you for your time and consideration. Sincerely, Isla Cisneros. View All Job Cover Letter Samples. Customize this Letter.

Reinsurance Underwriter Cover Letter Sample. Dear [Hiring Manager], I am writing to express my interest in the position of Reinsurance Underwriter at [Company Name]. With a master's degree in Statistical Risk Analysis and Financial Modeling, and five years of experience in the reinsurance industry, I am confident that I can bring a great deal ...