Financial Ratio Analysis Essay

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Current ratio

Total assets to debt ratio, quick ratio, profit margin ratio.

Calculations on financial ratios are basically derived from information obtained from the accounting records. The ratios provide the required guidelines of measuring the progress of the business and at the same time alert the management on the problems that might occur within the Company businesses.

The profitability ratios indicate the level of efficiency on how capital is being utilized. Liquidity ratios on the other hand help in indicating the ability of the Company to continue with its normal operations even in the midst of unexpected problems. While growth ratios are best used in the process of tracking down the financial progress of the Company (Graham, & Campbell, 2001, pp 187-243).

Compute the following ratios for 2009, and show supporting calculations (define each of the ratios, and explain them in simple terms

The current ratio is obtained through calculations derived from current assets and current liabilities. The ratio shows the relationship between current assets and current liabilities. The current assets refer to assets that are in form of cash or could easily be converted into cash within a short time.

While Current Liabilities, refer to liabilities that could be compensated or repaid within a short period of time. This ratio measures the company’s ability to settle short-term liabilities effectively and promptly (Graham, & Campbell, 2001, pp 187-243).

The ratio reveals the number of times the current assets could be used for the purposes of settling current liabilities. In normal circumstances the current assets should always be twice the current liabilities. However, any organization should have reasonable current ratio since higher ratio on this gives an indication of poor financial utilization. On the other hand, low ratio is an indication of insufficient working capital; hence the enterprise cannot settle its current liabilities (Keown et al, 1998).

Current Ratio = Current Assets/ current liabilities

= 220,000/80,000

The short term financial position of the company can be said to be satisfactory enabling the settling of current liabilities. But at the same time the ratio seem higher showing poor utilization of finances (Pink et al, 2007, pp 87-96).

This ratio compares the relationship between total assets and Long term debts. The total assets used under this calculation include fixed and current assets. This does not include fictitious assets which includes preliminary expenses, discount on share issue amongst others.

The Long term debts refers to debts that their maturity is considered due after a period of one year, these include; bonds, loans from banks and debentures. This ration is used by providers of long-term debts as measurement of safe bench mark for any business Institution.

The higher the ratio the better it means for the lenders based on the security involved in granting long-term loans to businesses. The lower the ratio the risky the business since it reveals that the business is heavily dependent on outside loans for survival. The ideal ratio for this calculation is normally 2:1 (Graham, & Campbell, 2001, pp 187-243).

Total Assets to Debt Ratio = Total Assets/Long Term Debts

= 1,000,000/300,000

The ratio is higher showing that the company’s security on loans is stable. This acts as assurance to lenders hence the company is capable of withstanding long-term loans.

This shows the relationship between liquid assets and the current liabilities which is normally analyzed for the purposes of assessing the short-term liquidity of the company. Liquid assets refer to assets inform of cash or those that could be converted to cash in a short duration of time (Graham, & Campbell, 2001, pp 187-243).The calculations are as shown below;

Quick Ratio = Liquid assets /current Liabilities

Liquid assets = Current assets – (stock + Prepaid Expenses)

= 100,000/80,000

The Quick ratio of the company is satisfactory; this makes the company to be at stable position to meet its obligations.

The profitability ratio indicates the ability of the company to plough back enough finances necessary for replacing the assets and also meet the increasing cases of services rendered to the company (Younis and Rice, 2001, pp 65-73)

Gross profit margin (%) = (gross income/ sales) ×100%

= (395,000/2,000,000) ×100%

Net profit margin = (Net income/sales) ×100%

= (255,000/2,000,000) ×100%

Both the gross profit and the Net profit margin are not satisfactory, showing that the company is not at a position which could enable it to frequently supply finances necessary to replace assets and increase the services required. The level of efficiency on how capital is being utilized is unsatisfactory.

Graham, J. R., & Campbell R. (2001). The Theory and Practice of Corporate

Finance: Evidence from the Field. Journal of Financial Economics , (60), 187-243.

Keown, A., J.W. Petty, D.F. Scott & Martin, J., (1998). Foundations of Finance. 2 nd

Edition. London: Prentice Hall, Inc.

Pink, G., Imtiaz, D., McGillis, L. & Mckillop, I. (2007). Selection of Key

Financial Indicators: A literature, Panel and Survey Approach. Healthcare Quarterly Journal , (10), 87-96

Younis, B., & Rice, B. (2001). An empirical investigation of hospital profitability in The post- PPS era. Journal of Health Care Finance , (28), 65-73.

- Web Quest of Employee Business

- Feasibility study for a new business

- The Methods of Settling International Disputes

- Ratios. Debt Service to Income Ratio

- Indonesian Students Settling in Seattle

- Lighting System: Incandescent or Fluorescent Lamps

- Leasing Buildings Advantages and Disadvantages

- International Trade Advantages and Limitations

- Economics of Sport and Recreation

- Implications of Reforms in the Euro-zone

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2018, May 24). Financial Ratio Analysis. https://ivypanda.com/essays/financial-ratio-analysis/

"Financial Ratio Analysis." IvyPanda , 24 May 2018, ivypanda.com/essays/financial-ratio-analysis/.

IvyPanda . (2018) 'Financial Ratio Analysis'. 24 May.

IvyPanda . 2018. "Financial Ratio Analysis." May 24, 2018. https://ivypanda.com/essays/financial-ratio-analysis/.

1. IvyPanda . "Financial Ratio Analysis." May 24, 2018. https://ivypanda.com/essays/financial-ratio-analysis/.

Bibliography

IvyPanda . "Financial Ratio Analysis." May 24, 2018. https://ivypanda.com/essays/financial-ratio-analysis/.

Financial Ratio Analysis

Home › Finance › Financial Ratio Analysis › Financial Ratio Analysis

Financial ratios are mathematical comparisons of financial statement accounts or categories. These relationships between the financial statement accounts help investors, creditors, and internal company management understand how well a business is performing and of areas needing improvement.

Financial ratios are the most common and widespread tools used to analyze a business’ financial standing. Ratios are easy to understand and simple to compute. They can also be used to compare different companies in different industries. Since a ratio is simply a mathematically comparison based on proportions, big and small companies can be use ratios to compare their financial information. In a sense, financial ratios don’t take into consideration the size of a company or the industry. Ratios are just a raw computation of financial position and performance.

Ratios allow us to compare companies across industries, big and small, to identify their strengths and weaknesses. Financial ratios are often divided up into seven main categories: liquidity, solvency, efficiency, profitability, market prospect, investment leverage, and coverage.

- Liquidity Ratios

- Solvency Ratios

- Efficiency Ratios

- Profitability Ratios

- Market Prospect Ratios

- Financial Leverage Ratios

- Coverage Ratios

- Receivables Turnover Ratio

- Asset Turnover Ratio

- Cash Conversion Cycle

- Compound Annual Growth Rate

- Contribution Margin

- Current Ratio

- Days Sales in Inventory

- Days Sales Outstanding

- Debt Service Coverage Ratio

- Debt to Equity Ratio

- Dividend Payout

- Dividend Yield

- DuPont Analysis

- Earnings per Share

- Equity Multiplier

- Equity Ratio

- Fixed Charge Coverage Ratio

- Gross Margin Ratio

- Interest Coverage Ratio

- Internal Rate of Return

- Inventory Turnover Ratio

- Net Working Capital

- Operating Margin Ratio

- Payables Turnover Ratio

- Price Earnings P/E Ratio

- Profit Margin Ratio

- Quick Ratio – Acid Test

- Retention Rate

- Return on Assets

- Return on Capital Employed

- Return on Equity

- Times Interest Earned Ratio

- Working Capital Ratio

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Financial Statements

Financial Ratios

- Financial Ratio

- Accumulated Depreciation Ratio

- Asset Coverage Ratio

- Average Inventory Period

- Average Payment Period

- Break-Even Analysis

- Capitalization Ratio

- Cash Earnings/Share

- Cash Flow Coverage Ratio

- Correlation Coefficient

- Cost of Goods Sold

- Days Payable Outstanding

- Debt to Asset

- Debt to Capital

- Debt to Income

- Defensive Interval

- Earnings Per Share

- Enterprise Value

- Expense Ratio

- Fixed Asset Turnover Ratio

- Free Cash Flow

- Goodwill to Assets

- Gross Profit

- Gross vs Net

- Loan to Value

- Long Term Debt to Assets

- Margin of Safety

- Marginal Revenue

- Net Fixed Assets

- Net Interest Margin

- Net Operating Income

- Net Present Value (NPV)

- Net Profit Margin

- Operating Cash Flow

- Operating Income

- Operating Leverage

- Payback Period

- Preferred Dividend Coverage

- Present Value

- Price to Book

- Price to Cash Flow

- Price to Sales

- Residual Income

- Retention Ratio

- Return on Invested Capital

- Return on Investment

- Return on Net Assets

- Return on Operating Assets

- Return on Retained Earnings

- Return on Sales

- Sales to Admin Expenses

- Sharpe Ratio

- Sortino Ratio

- Treynor Ratio

- Search Search Please fill out this field.

- Working Capital Ratio

- Quick Ratio

- Earnings Per Share (EPS)

- Price-to-Earnings (P/E) Ratio

- Debt-to-Equity (D/E) Ratio

- Return on Equity (ROE)

The Bottom Line

- Corporate Finance

- Financial Ratios

6 Basic Financial Ratios and What They Reveal

:max_bytes(150000):strip_icc():format(webp)/NatalyaYashina234619_smallerfile-ca61e07c6ec9470c9a0e5a074bf5b359.jpg)

- Business Valuation: 6 Methods for Valuing a Company

- Valuation Analysis

- Financial Statements

- Balance Sheet

- Cash Flow Statement

- 6 Basic Financial Ratios CURRENT ARTICLE

- 5 Must-Have Metrics for Value Investors

- Price-to-Earnings Ratio (P/E Ratio)

- Price-To-Book Ratio (P/B Ratio)

- Price/Earnings-to-Growth (PEG Ratio)

- Fundamental Analysis

- Absolute Value

- Relative Valuation

- Intrinsic Value of a Stock

- Intrinsic Value vs. Current Market Value

- Equity Valuation: The Comparables Approach

- 4 Basic Elements of Stock Value

- How to Become Your Own Stock Analyst

- Due Diligence in 10 Easy Steps

- Determining the Value of a Preferred Stock

- Qualitative Analysis

- Stock Valuation Methods

- Bottom-Up Investing

- Ratio Analysis

- What Book Value Means to Investors

- Liquidation Value

- Market Capitalization

- Discounted Cash Flow (DCF)

- Enterprise Value (EV)

- How to Use Enterprise Value to Compare Companies

- How to Analyze Corporate Profit Margins

- Decoding DuPont Analysis

- How to Value Private Companies

- Valuing Startup Ventures

Ratios track company performance. They can rate and compare one company against another that you might be considering investing in. The term “ratio” conjures up complex and frustrating high school math problems, but that need not be the case. Ratios can help make you a more informed investor when they’re properly understood and applied .

Key Takeaways

- Fundamental analysis relies on data from corporate financial statements to compute various ratios.

- Fundamental analysis is used to determine a security ’s intrinsic or true value so it can be compared with the security’s market value.

- There are six basic ratios that are often used to pick stocks for investment portfolios.

- Ratios include the working capital ratio, the quick ratio, earnings per share (EPS), price-to-earnings (P/E), debt-to-equity (D/E), and return on equity (ROE).

- Most ratios are best used in combination with others rather than singly to accomplish a comprehensive picture of a company ’s financial health.

1. Working Capital Ratio

Assessing the health of a company in which you want to invest involves measuring its liquidity . The term “liquidity” refers to how easily a company can turn assets into cash to pay short-term obligations. The working capital ratio can be useful in helping you measure liquidity. It represents a company’s ability to pay its current liabilities with its current assets.

Working capital is the difference between a firm’s current assets and current liabilities:

current assets - current liabilities = working capital

The working capital ratio, like working capital, compares current assets to current liabilities and is a metric used to measure liquidity. The working capital ratio is calculated by dividing current assets by current liabilities :

current assets / current liabilities = working capital ratio

Let’s say that Company XYZ has current assets of $8 million and current liabilities of $4 million. The working capital ratio is 2 ($8 million / $4 million) . That’s an indication of healthy short-term liquidity. But what if two similar companies each had ratios of 2? The firm with more cash among its current assets would be able to pay off its debts more quickly than the other.

A working capital ratio of 1 can imply that a company may have liquidity troubles and not be able to pay its short-term liabilities. But the trouble could be temporary and later improve.

A working capital ratio of 2 or higher can indicate healthy liquidity and the ability to pay short-term liabilities, but it could also point to a company that has too much in short-term assets such as cash. Some of these assets might be better used to invest in the company or to pay shareholder dividends.

It can be a challenge to determine the proper category for the vast array of assets and liabilities on a corporate balance sheet to decipher the overall ability of a firm to meet its short-term commitments.

2. Quick Ratio

The quick ratio is also called the acid test. It’s another measure of liquidity. It represents a company’s ability to pay current liabilities with assets that can be converted to cash quickly.

The calculation for the quick ratio is:

current assets - inventory prepaid expenses / current liabilities

The formula removes inventory because it can take time to sell and convert inventory into liquid assets .

Company XYZ has $8 million in current assets, $2 million in inventory and prepaid expenses, and $4 million in current liabilities. That means the quick ratio is 1.5 ($8 million - $2 million / $4 million) . It indicates that the company has enough money to pay its bills and continue operating.

A quick ratio of less than 1 can indicate that there aren’t enough liquid assets to pay short-term liabilities. The company may have to raise capital or take other actions. On the other hand, it may be a temporary situation.

3. Earnings Per Share (EPS)

When buying a stock, you participate in the future earnings or the risk of loss of the company. Earnings per share (EPS) is a measure of the profitability of a company. Investors use it to gain an understanding of company value.

The company’s analysts calculate EPS by dividing net income by the weighted average number of common shares outstanding during the year:

net income / weighted average = earnings per share

Earnings per share will also be zero or negative if a company has zero earnings or negative earnings representing a loss. A higher EPS indicates greater value.

4. Price-to-Earnings (P/E) Ratio

Called P/E for short, this ratio is used by investors to determine a stock’s potential for growth. It reflects how much they would pay to receive $1 of earnings. It’s often used to compare the potential value of a selection of stocks.

To calculate the P/E ratio, divide a company’s current stock price by its earnings per share to calculate the P/E ratio:

current stock price/earnings per share = price-earnings ratio

A company’s P/E ratio would be 9.49 ($46.51 / $4.90) if it closed trading at $46.51 a share and the EPS for the past 12 months averaged $4.90. Investors would spend $9.49 for every generated dollar of annual earnings.

Investors have been willing to pay more than 20 times the EPS for certain stocks when they’ve felt that a future growth in earnings would give them adequate returns on their investments .

The P/E ratio will no longer make sense if a company has zero or negative earnings. It will appear as N/A for “not applicable.”

Ratios can help improve your investing results when they’re properly understood and applied.

5. Debt-to-Equity (D/E) Ratio

What if your prospective investment target is borrowing too much? This can increase fixed charges, reduce earnings available for dividends, and pose a risk to shareholders.

The debt-to-equity (D/E) ratio measures how much a company is funding its operations using borrowed money. It can indicate whether shareholder equity can cover all debts, if necessary. Investors often use it to compare the leverage used by different companies in the same industry. This can help them to determine which might be a lower-risk investment.

Divide total liabilities by total shareholders’ equity to calculate the debt-to-equity ratio:

total liabilities / total shareholders’ equity = debt-to-equity ratio

Let’s say that Company XYZ has $3.1 million worth of loans and shareholders’ equity of $13.3 million. That works out to a modest ratio of 0.23, which is acceptable under most circumstances.

However, like all other ratios, the metric must be analyzed in terms of industry norms and company-specific requirements.

6. Return on Equity (ROE)

Return on equity (ROE) measures profitability and how effectively a company uses shareholder money to make a profit. ROE is expressed as a percentage of common-stock shareholders.

It’s calculated by taking net income (income less expenses and taxes) figured before paying common-share dividends and after paying preferred-share dividends. Divide the result by total shareholders’ equity:

net income (expenses and taxes before paying common share dividends and after paying preferred share dividends) / total shareholders’ equity = return on equity

Let’s say Company XYZ’s net income is $1.3 million. Its shareholder equity is $8 million. ROE is therefore 16.25%. The higher the ROE, the better the company is at generating profits using shareholder equity.

What Is a Good ROE?

Return on equity, or ROE, is a metric used to analyze investment returns. It’s a measure of how effectively a company uses shareholder equity to generate income. You might consider a good ROE to be one that increases steadily over time. This could indicate that a company does a good job using shareholder funds to increase profits. That can, in turn, increase shareholder value .

What Is Fundamental Analysis?

Fundamental analysis is the analysis of an investment or security to discover its true or intrinsic value . It involves the study of economic, industry, and company information.

Fundamental analysis can be useful because an investor can determine if the security is fairly priced, overvalued, or undervalued by comparing its true value to its market value.

Fundamental analysis contrasts with technical analysis, which focuses on determining price action and uses different tools to do so, such as chart patterns and price trends.

Is a Higher or Lower P/E Ratio Better?

It depends on what you’re looking for in an investment. A price-to-earnings (P/E) ratio measures the relationship of a stock’s price to earnings per share. A lower P/E ratio can indicate that a stock is undervalued and perhaps worth buying, but it could be low because the company isn’t financially healthy .

A higher P/E ratio can indicate that a stock is expensive, but that could be because the company is doing well and could continue to do so.

The best way to use P/E is often as a relative value comparison tool for stocks you’re interested in, or you might want to compare the P/E of one or more stocks to an industry average.

Financial ratios can help you pick the best stocks for your portfolio and build your wealth. Dozens of financial ratios are used in fundamental analysis . We’ve briefly highlighted six of the most common and the easiest to calculate.

Remember that a company cannot be properly evaluated using just one ratio in isolation. Be sure to use a variety of ratios for more confident investment decision making.

American Express. “ Working Capital Formula & Ratio: How to Calculate Working Capital .”

Accounting for Management. “ Quick Ratio or Acid Test Ratio .”

Carbon Collective. “ Earnings Per Share .”

Robinhood Learn. “ What Is the Debt to Equity Ratio? ”

Charles Schwab. “ Stock Analysis Using the P/E Ratio .”

:max_bytes(150000):strip_icc():format(webp)/EPS-final-838bf0756ca04435ae9e15237ca914a7.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

What is Ratio Analysis?

Uses of ratio analysis.

- Ratio Analysis - Categories of Financial Ratios

Related Readings

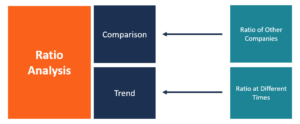

Ratio analysis.

Comparisons between the financial information in the financial statements of a business

Ratio analysis refers to the analysis of various pieces of financial information in the financial statements of a business. They are mainly used by external analysts to determine various aspects of a business, such as its profitability, liquidity, and solvency.

Analysts rely on current and past financial statements to obtain data to evaluate the financial performance of a company. They use the data to determine if a company’s financial health is on an upward or downward trend and to draw comparisons to other competing firms.

1. Comparisons

One of the uses of ratio analysis is to compare a company’s financial performance to similar firms in the industry to understand the company’s position in the market. Obtaining financial ratios, such as Price/Earnings, from known competitors and comparing them to the company’s ratios can help management identify market gaps and examine its competitive advantages , strengths, and weaknesses. The management can then use the information to formulate decisions that aim to improve the company’s position in the market.

2. Trend line

Companies can also use ratios to see if there is a trend in financial performance. Established companies collect data from financial statements over a large number of reporting periods. The trend obtained can be used to predict the direction of future financial performance , and also identify any expected financial turbulence that would not be possible to predict using ratios for a single reporting period.

3. Operational efficiency

The management of a company can also use financial ratio analysis to determine the degree of efficiency in the management of assets and liabilities. Inefficient use of assets such as motor vehicles, land, and buildings results in unnecessary expenses that ought to be eliminated. Financial ratios can also help to determine if the financial resources are over- or under-utilized.

Ratio Analysis – Categories of Financial Ratios

There are numerous financial ratios that are used for ratio analysis, and they are grouped into the following categories:

1. Liquidity ratios

Liquidity ratios measure a company’s ability to meet its debt obligations using its current assets. When a company is experiencing financial difficulties and is unable to pay its debts, it can convert its assets into cash and use the money to settle any pending debts with more ease.

Some common liquidity ratios include the quick ratio , the cash ratio, and the current ratio. Liquidity ratios are used by banks, creditors, and suppliers to determine if a client has the ability to honor their financial obligations as they come due.

2. Solvency ratios

Solvency ratios measure a company’s long-term financial viability. These ratios compare the debt levels of a company to its assets, equity, or annual earnings.

Important solvency ratios include the debt to capital ratio, debt ratio, interest coverage ratio, and equity multiplier. Solvency ratios are mainly used by governments, banks, employees, and institutional investors.

3. Profitability Ratios

Profitability ratios measure a business’ ability to earn profits, relative to their associated expenses. Recording a higher profitability ratio than in the previous financial reporting period shows that the business is improving financially. A profitability ratio can also be compared to a similar firm’s ratio to determine how profitable the business is relative to its competitors.

Some examples of important profitability ratios include the return on equity ratio, return on assets, profit margin, gross margin, and return on capital employed .

4. Efficiency ratios

Efficiency ratios measure how well the business is using its assets and liabilities to generate sales and earn profits. They calculate the use of inventory, machinery utilization, turnover of liabilities, as well as the usage of equity. These ratios are important because, when there is an improvement in the efficiency ratios, the business stands to generate more revenues and profits.

Some of the important efficiency ratios include the asset turnover ratio , inventory turnover, payables turnover, working capital turnover, fixed asset turnover, and receivables turnover ratio.

5. Coverage ratios

Coverage ratios measure a business’s ability to service its debts and other obligations. Analysts can use the coverage ratios across several reporting periods to draw a trend that predicts the company’s financial position in the future. A higher coverage ratio means that a business can service its debts and associated obligations with greater ease.

Key coverage ratios include the debt coverage ratio, interest coverage, fixed charge coverage, and EBIDTA coverage.

6. Market prospect ratios

Market prospect ratios help investors to predict how much they will earn from specific investments. The earnings can be in the form of higher stock value or future dividends. Investors can use current earnings and dividends to help determine the probable future stock price and the dividends they may expect to earn.

Key market prospect ratios include dividend yield, earnings per share, the price-to-earnings ratio , and the dividend payout ratio.

Thank you for reading CFI’s guide to Ratio Analysis. To keep learning and advancing your career, the following CFI resources will be helpful:

- Analysis of Financial Statements

- Current Ratio Formula

- Financial Analysis Ratios Glossary

- Limitations of Ratio Analysis

- See all accounting resources

- See all capital markets resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Essay on Financial Ratios

Introduction

Financial ratios provide a holistic picture of an organization’s financial health, and allow us to benchmark the organization’s performance against those of other organizations over time and over the relevant sector. This assignment will define the liquidity, leverage, management efficiency, and profitability ratio groups, as well as the respective financial ratios under each group. The following assignment was formulated with joint inputs from team members Crystal Mayfield, Crystal Kierum, Gunnar Wagner and Crystal Vining, of Group A2.

Liquidity Ratios

This group of ratios provides an analysis of whether the company has the capability of meeting its short-term financial liabilities, based on whether it can cash in its receivables and inventories to cover liabilities. Higher liquidity ratios demonstrate a stronger financial ability to pay the company’s current liabilities if they are due. Practical applications of liquidity ratios include the assessment of the firm’s solvency, qualification for loan applications at banks, and analysis of the firm’s liquidity position over time (Gibbons et al, 2015).

- Current Ratio = Current Assets / Current Liabilities

- Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Leverage Ratios

This group of ratios tracks the degree of debt on a company’s balance sheet, with a higher debt to equity or debt to total asset ratio indicating a company that is higher in debt and potentially more risky. This is because higher debt levels in a firm indicate a higher breakeven point and a more volatile return on equity, and will show up in a higher ratio of debt to equity or assets, suggesting the company is largely financed by taking on additional debt than equity. This would differ across sectors, with capital expenditure heavy sectors such as manufacturing and pipeline infrastructure generally having higher leverage ratios due to the debt financing they would need to finance their capital expenditures (Gibbons et al, 2015).

- Debt to Equity = (Short-Term Debt + Long-Term Debt) / Total Shareholders’ Equity

- Debt to Total Assets = (Short-Term Debt + Long-Term Debt) / Total Assets

- Interest Coverage = EBIT Operating Profit / Interest Expense

Management Efficiency Ratios

This group of ratios demonstrates the extent that the firm is efficiency utilising its assets and stewarding its liabilities, with accounts receivable turnover showing the number of times a company makes in sales (turnover) as compared to its accounts receivable, and may be an indicator of an overly generous credit policy or debt collection issues. Similarly, days of sales outstanding and inventory measure how long a company can move its sales or turn inventory into cash (Gibbons et al, 2015).

- Accounts Receivable Turnover = Sales / Accounts Receivable

- Days Sales Outstanding = 365 / Accounts Receivable Turnover

- Days of Inventory = 365 / Inventory Turnover

- Accounts Payable Turnover = Costs of Goods Sold / Accounts Payable

Profitability Ratios

Finally, profitability ratios demonstrate whether a company can generate earnings relative to its costs, therefore evaluating the margin achieved by a business based on the efficiency of its material and labor utilisation, as well as its pricing strategy, cost structure and productivity. A higher profitability ratio indicates a more profitable business and strong growth prospects (Arditti, 1967).

- Gross Margin = (Sales – Cost of Goods Sold) / Sales

- Operating Margin = EBIT Operating Income / Sales

- Return on Assets = ( Net Income + [ Interest Expense * (1-T) ] ) / Total Assets

- Return on Equity = Net Income / Total Shareholders’ Equity

Arditti, F. D. (1967). Risk and the required return on equity. The Journal of Finance , 22 (1), 19-36. https://www.jstor.org/stable/2977297

Besley, S., & Brigham, E. F. (2013). Principles of finance. Cengage Learning.

Gibbons, G., Hisrich, R. D., & DaSilve, C. M. (2015). Entrepreneurial finance: A global perspective. Thousand Oaks, CA: Sage.

Gitman, L. J., Juchau, R., & Flanagan, J. (2015). Principles of managerial finance . Pearson Higher Education AU.

Ruppert, D. (2014). Statistics and finance: An introduction . Springer.

Cite this page

Similar essay samples.

- To what extent can it be argued that the acidification of soils in hum...

- Essay on the Ballot Behind Bars

- Project management and quality plan for designing and implementing an ...

- Leading contributors of carbon dioxide emissions in Germany

- (Re)presenting Masculinity: Crises, Superheroes, Androgyny.

- Taglit-Birthright Israel: Tourism as a Tool for Building Identity

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

What Is Financial Ratio Analysis?

Overview, Definition, and Calculation of Financial Ratios

Types of Financial Ratios

- How Financial Ratio Analysis Works

Interpretation of Financial Ratio Analysis

Who uses financial ratio analysis, frequently asked questions (faqs).

Getty Images/Trevor Williams

Financial ratio analysis uses the data contained in financial documents like the balance sheet and statement of cash flows to assess a business's financial strength. These financial ratios help business owners and average investors assess profitability, solvency, efficiency, coverage, market value, and more.

Key Takeaways

- Financial ratio analysis assesses the performance of the firm's financial functions of liquidity, asset management, solvency, and profitability.

- Financial ratio analysis is a powerful analytical tool that can give the business firm a complete picture of its financial performance on both a trend and an industry basis.

- The information gleaned from a firm's financial statements by ratio analysis is useful for financial managers, competitors, and average investors.

- Financial ratio analysis is only useful if data is compared to past performance or to other companies in the same industry.

Financial ratios are useful tools that help business managers, owners, and potential investors analyze and compare financial health. They are one tool that makes financial analysis possible across a firm's history, an industry, or a business sector.

Financial ratio analysis uses the data gathered from these ratios to make decisions about improving a firm's profitability, solvency, and liquidity.

There are six categories of financial ratios that business managers normally use in their analysis. Within these six categories are multiple financial ratios that help a business manager and outside investors analyze the financial health of the firm.

It's important to note that financial ratios are only meaningful in comparison to other ratios for different time periods within the firm. They can also be used for comparison to the same ratios in other industries, for other similar firms, or for the business sector.

Liquidity Ratios

The liquidity ratios answer the question of whether a business firm can meet its current debt obligations with its current assets. There are three major liquidity ratios that business managers look at:

- Working capital ratio : This ratio is also called the current ratio (current assets - current liabilities). These figures are taken off the firm's balance sheet. It measures whether the business can pay its short-term debt obligations with its current assets.

- Quick ratio: This ratio is also called the acid test ratio (current assets - inventory/current liabilities). These figures come from the balance sheet. The quick ratio measures whether the firm can meet its short-term debt obligations without selling any inventory.

- Cash ratio : This liquidity ratio (cash + cash equivalents/current liabilities) gives analysts a more conservative view of the firm's liquidity since it uses only cash and cash equivalents, such as short-term marketable securities, in the numerator. It indicates the ability of the firm to pay off all its current liabilities without liquidating any other assets.

Efficiency Ratios

Efficiency ratios, also called asset management ratios or activity ratios, are used to determine how efficiently the business firm is using its assets to generate sales and maximize profit or shareholder wealth. They measure how efficient the firm's operations are internally and in the short term. The four most commonly used efficiency ratios calculated from information from the balance sheet and income statement are:

- Inventory turnover ratio: This ratio (sales/inventory) measures how quickly inventory is sold and restocked or turned over each year. The inventory turnover ratio allows the financial manager to determine if the firm is stocking out of inventory or holding obsolete inventory.

- Days sales outstanding: Also called the average collection period (accounts receivable/average sales per day), this ratio allows financial managers to evaluate the efficiency with which the firm is collecting its outstanding credit accounts.

- Fixed assets turnover ratio: This ratio (sales/net fixed assets) focuses on the firm's plant, property, and equipment, or its fixed assets, and assesses how efficiently the firm uses those assets.

- Total assets turnover ratio: The total assets turnover ratio (sales/total assets) rolls the evidence of the firm's efficient use of its asset base into one ratio. It allows analysts to gauge how efficiently the asset base is generating sales and profitability.

Solvency Ratios

A business firm's solvency, or debt management, ratios allow the analyst to appraise the position of the business firm's debt financing or financial leverage that they use to finance their operations. The solvency ratios gauge how much debt financing the firm uses as compared to either its retained earnings or equity financing. There are two major solvency ratios:

- Total debt ratio : The total debt ratio (total liabilities/total assets) measures the percentage of funds for the firm's operations obtained by a combination of current liabilities plus its long-term debt.

- Debt-to-equity ratio : This ratio (total liabilities/total assets - total liabilities) is most important if the business is publicly traded. The information from this ratio is essentially the same as from the total debt ratio, but it presents the information in a form that investors can more readily utilize when analyzing the business.

Coverage Ratios

The coverage ratios measure the extent to which a business firm can cover its debt obligations and meet the associated costs. Those obligations include interest expenses, lease payments, and, sometimes, dividend payments. These ratios work with the solvency ratios to give a financial manager a full picture of the firm's debt position. Here are the two major coverage ratios:

- Times interest earned ratio: This ratio (earnings before interest and taxes (EBIT)/interest expense) measures how well a business can service its total debt or cover its interest payments on debt.

- Debt service coverage ratio: The DSCR (net operating income/total debt service charges) is a valuable summary ratio that allows the firm to get an idea of how well the firm can cover all of its debt service obligations.

Profitability Ratios

Profitability ratios are the summary ratios for the business firm. When profitability ratios are calculated, they sum up the effects of liquidity management, asset management, and debt management on the firm. The four most common and important profitability ratios are:

- Net profit margin: This ratio (net income/sales) shows the profit per dollar of sales for the business firm.

- Return on total assets (ROA): The ROA ratio (net income/sales) indicates how efficiently every dollar of total assets generates profit.

- Basic earning power (BEP): BEP (EBIT/total assets) is similar to the ROA ratio because it measures the efficiency of assets in generating sales. However, the BEP ratio makes the measurement free of the influence of taxes and debt.

- Return on equity (ROE): This ratio (net income/common equity) indicates how much money shareholders make on their investment in the business firm. The ROE ratio is most important for publicly traded firms.

Market Value Ratios

Market Value Ratios are usually calculated for publicly held firms and are not widely used for very small businesses. Some small businesses are, however, traded publicly. There are three primary market value ratios:

- Earnings per share (EPS): As the name implies, this measurement conveys the business's earnings on a per-share basis. It is calculated by dividing the net income by the outstanding shares of common stock.

- Price/earnings ratio (P/E): The P/E ratio (stock price per share/earnings per share) shows how much investors are willing to pay for the stock of the business firm per dollar of profits.

- Price/cash flow ratio: A business firm's value is dependent on its free cash flows. The price/cash flow ratio (stock price/cash flow per share) assesses how well the business generates cash flow.

- Market/book ratio: This ratio (stock price/book value per share) gives the analyst another indicator of how investors view the value of the business firm.

- Dividend yield: The dividend yield divides a company's annual dividend payments by its stock price to help investors estimate their passive income. Dividends are typically paid quarterly, and each payment can be annualized to update the dividend yield throughout the year.

- Dividend payout ratio: The dividend payout ratio is similar to the dividend yield, but it's relative to the company's earnings rather than the stock price. To calculate this ratio, divide the dollar amount of dividends paid to investors by the company's net income.

How Does Financial Ratio Analysis Work?

Financial ratio analysis is used to extract information from the firm's financial statements that can't be evaluated simply from examining those statements. Ratios are generally calculated for either a quarter or a year.

To calculate financial ratios, an analyst gathers the firm's balance sheet, income statement, and statement of cash flows, along with stock price information if the firm is publicly traded. Usually, this information is downloaded to a spreadsheet program.

Small businesses can set up their spreadsheet to automatically calculate each of these financial ratios.

One ratio calculation doesn't offer much information on its own. Financial ratios are only valuable if there is a basis of comparison for them. Each ratio should be compared to past periods of data for the business. The ratios can also be compared to data from other companies in the industry.

It is only after comparing the financial ratios to other time periods and to the companies' ratios in the industry that an analyst can draw conclusions about the firm performance.

For example, if a firm's debt-to-asset ratio for one time period is 50%, that doesn't tell a useful story unless it's compared to previous periods, especially if the debt-to-asset ratio was much lower or higher historically. In this scenario, the debt-to-asset ratio shows that 50% of the firm's assets are financed by debt. The financial manager or an investor wouldn't know if that is good or bad unless they compare it to the same ratio from previous company history or to the firm's competitors.

Performing an accurate financial ratio analysis and comparison helps companies gain insight into their financial position so that they can make necessary financial adjustments to enhance their financial performance.

There are other financial analysis techniques that owners and potential investors can combine with financial ratios to add to the insights gained. These include analyses such as common size analysis and a more in-depth analysis of the statement of cash flows.

Several stakeholders might need to use financial ratio analysis:

- Financial managers : Financial managers must have the information that financial ratio analysis imparts about the performance of the various financial functions of the business firm. Ratio analysis is a valuable and powerful financial analysis tool.

- Competitors : Other business firms find the information about the other firms in their industry important for their own competitive strategy.

- Investors : Current and potential investors (whether publicly traded or financed by venture capital) need the financial information gleaned from ratio analysis to determine whether or not they want to invest in the business.

What are 5 key financial ratios?

Five of the most important financial ratios for new investors include the price-to-earnings ratio, the current ratio, return on equity, the inventory turnover ratio, and the operating margin.

Why is financial ratio analysis important?

Financial ratio analysis quickly gives you insight into a company's financial health. Rather than having to look at raw revenue and expense data, owners and potential investors can simply look up financial ratios that summarize the information they want to learn.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Wells Fargo. " 5 Ways To Improve Your Liquidity Ratio ."

Morningstar. " Efficiency Ratios ."

OpenStax. " Principles of Finance: 6.4 Solvency Ratios ."

YCharts. " Times Interest Earned ."

Austin Water. " Financial Policies Update Frequently Asked Questions (FAQ) ."

Edward Lowe Foundation. " How To Analyze Profitability ."

Pamela P. Peterson, Pamela Peterson Drake, Frank J. Fabozzi, " Analysis of Financial Statements ," Pages 76-77. Wiley, 1999.

Nasdaq. " Return on Equity (ROE) ."

OpenStax. " Principles of Finance: 6.5 Market Value Ratios ."

OpenStax. " Principles of Finance: 11.1 Multiple Approaches to Stock Valuation ."

Rodney Hobson. " The Dividend Investor ." Harriman House, 2012.

Corporate Finance Institute. " Financial Ratios ."

Edward Lowe Foundation. " How To Analyze Your Business Using Financial Ratios ."

Essay on Financial Ratios (For Students) | Company | Accounting

Read this essay to learn about:- 1. Meaning of Financial Ratios 2. Liquidity Ratios 3. Solvency Ratios 4. Profitability Ratios 5. Turnover Ratios 6. Ratios for Shareholders and Potential Investors 7. Coverage Ratios 8. Debt-Service Ratios 9. Cost Ratios 10. Calculation of Different Ratios.

Essay # 1. Meaning of Financial Ratios:

Financial ratios express relationship between two financial variables. For example, sales is one element of profit and loss account and profit after tax (PAT) is another element.

Cite This Work

To export a reference to this article please select a referencing style below:

Related Essays

Foreign direct investment in saudi arabia, the 21 irrefutable laws of leadership, beta and capital budgeting (yahoo), business strategy: critically relate innovation and strategy, individual comparison report between the case study of samsung and blackberry, exploring samsung’s organizational structure: challenges, benefits, and adaptations, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

- Call to +1 844 889-9952

Financial Analysis and Financial Ratios

| 📄 Words: | 856 |

|---|---|

| 📝 Subject: | |

| 📑 Pages: | 3 |

| ✍️ Type: | Essay |

The Use of Financial Ratios

Limitations of financial ratio analysis, the appropriate use of financial ratios, liquidity ratios, solvency ratios, profitability ratios.

One of the most important aspects of a company’s success is its finances. When finances are orderly and stable, a company is able to generate profit efficiently, expand the value of original investments, and simultaneously compensate for liabilities (Myšková & Hájek, 2017). Financial analysis and financial ratios are used to achieve those goals by accessing the company’s financial performance. Without being able to gauge financial losses and gains, it is challenging to devise necessary strategies for further development.

Financial ratios are an essential part of financial analysis. They are used in order to ascertain financial trends within a company’s structure, and they are widely preferred primarily due to their simplicity and informativity. In addition, financial ratios show variables relating to a particular industry. By using financial ratios, a company is able to create a reference point through which it understands its place in the market, its flaws, and its powers. In turn, it allows adjustment of current financial strategies and the development of new ones. They can be divided into categories of various indicators, such as profitability, liquidity, productivity, cost, capital market, capital structure, and solvency (Myšková & Hájek, 2017). Not all of these categories are strictly necessary to use while analyzing a company’s performance.

Despite its broad area of use, financial ratios do not come without certain limitations. To use ratios means to understand their limitations lest one meets an incorrect conclusion. The first limitation of ratio analysis is that the information provided by it is historic and not up to date. The second limitation comes from the fact that ratio analysis does not take into consideration world recession. The third limitation factor is linked to the influence of the human element, and the fourth concerns the unwillingness of other companies to share their data. The fifth limitation is that a company could only be compared with a company of its size and kind (“Purpose and limitations of ratio analysis”, n.d.).

In terms of a division of lenders into short-term lenders, long-term lenders, and stockholders, financial ratios vary accordingly. Each of these categories would require a different approach to ratio analysis depending on their goals and needs. First of all, for short-term lenders, it would be liquidity ratios, which are divided into several sub-categories. Secondly, long-term lenders would be mainly concerned with solvency ratios. Thirdly, for stockholders, the most appropriate would be profitability ratios.

As stated above, liquidity ratios would be preferred mainly by short-term lenders. These ratios show if a company is capable of meeting short-term commitments. Lenders need to be assured of a company’s capability to timely fulfill their agreements, and liquidity ratios help identify red flags in financial management in advance. Such red flags include the inability to pay wages and salaries on time, faulty tax payments, and poor accomplishment of other short-term goals (Aryasri. 2020). For example, if a company wants to obtain a loan, it needs to prove its creditworthiness. A lender or lenders would require a stability check since they need to be sure that their money would be returned.

Solvency ratios could be successfully used to attract long-term lenders. In fact, they are often used by prospective lenders because these ratios allow them to ascertain whether a company is able to pay off a lasting debt or meet long-term commitments. Solvency ratios measure cash flows instead of the net worth of a company to understand how its cash flow capacity could withstand its liabilities (Aryasri, 2020). For example, to provide lenders with additional guarantees, a company can refer to the interest cover ratio, which is the number of times it can cover its interest obligation using its profits.

For stockholders, the most appropriate way of financial analysis would be profitability ratios. Profitability ratios are defined as tools to determine a company’s ability to gain profit against its expenses and other costs related to generating the income. It essentially shows how profitable a company is and indicates funds distribution efficiency. High profitability ratios are a valuable asset for success among stockholders, and it generally means that a business performs very well (Aryasri, 2020). For example, if stockholders need to verify that a company’s infrastructure is run competently, they might use operating margin. The operating margin is a sub-category of profitability ratios that displays the effectiveness of a company’s core monetary operations. It is the portion of the profit that is dedicated to payments towards creditors, taxes, and stockholders. Therefore, the numbers confined in the operating margin would concern stockholders the most.

In conclusion, financial analysis and financial ratios are essential elements of business practice and establishing a healthy financial structure within a company. Despite the fact that these analysis strategies are broadly used, they possess specific limitations that their users should keep in mind. In addition, depending on the aim and circumstances of an individual lender, different categories of ratio analysis need to be employed. For short-term lenders, it is liquidity ratios; for long-term lenders, it is solvency ratios; and for stockholders, it is profitability ratios.

Aryasri, A. R. (2020). Business economics and financial analysis . McGraw-Hill Education (India) Pvt Ltd.

Myšková, R., & Hájek, P. (2017). Comprehensive assessment of firm financial performance using financial ratios and linguistic analysis of annual reports. Journal of International Studies, 10 (4), 96–108. Web.

Purpose and limitation of ratio analysis. (n.d.). Web.

Cite this paper

Select style

- Chicago (A-D)

- Chicago (N-B)

BusinessEssay. (2023, January 12). Financial Analysis and Financial Ratios. https://business-essay.com/financial-analysis-and-financial-ratios/

"Financial Analysis and Financial Ratios." BusinessEssay , 12 Jan. 2023, business-essay.com/financial-analysis-and-financial-ratios/.

BusinessEssay . (2023) 'Financial Analysis and Financial Ratios'. 12 January.

BusinessEssay . 2023. "Financial Analysis and Financial Ratios." January 12, 2023. https://business-essay.com/financial-analysis-and-financial-ratios/.

1. BusinessEssay . "Financial Analysis and Financial Ratios." January 12, 2023. https://business-essay.com/financial-analysis-and-financial-ratios/.

Bibliography

BusinessEssay . "Financial Analysis and Financial Ratios." January 12, 2023. https://business-essay.com/financial-analysis-and-financial-ratios/.

- Monetary Policy in the United States

- Microfinance in Germany and Austria

- Types of Auctions, Their Value, and Purpose in the Economy

- Financial Industry Analysis in Australia

- Impact of Financial Crises on College Students

- The Role of Money and Credit in the United States

- The Short-Run and Long-Run Relationship Between Unemployment and Inflation

- Fiscal and the Monetary Policies During the Great Recession

- The Financial Services Industry in Australia and COVID-19 Impact

- Cummins Inc.: Financial Analysis

Financial Ratios Analysis

All of the stakeholders in a business will be interested in analyzing financial statements and the accompanying financial ratios derived from those statements. Utilizing financial ratios, business managers and owners can assess performance over the long-term and adapt to industry trends. Financial ratios indicate clearly show areas of strength, potential problems, and weaknesses, which managers can use in making decisions. Furthermore, managers and owners can review financial ratios to measure progress toward company goals. Investors, creditors, lenders, suppliers, customers, and employees understand the financial strength and growth potential of the company on the basis of financial statements and ratios.

By converting information from financial statements into ratios, stakeholders can compare companies of different sizes since the ratios themselves control for size. Nevertheless, financial ratios do have some drawbacks, including time sensitivity and the ability to misled when viewed in isolation.

Financial Statements

Among the financial statements necessary for calculating financial ratios are the balance sheet and the income statement. The balance sheet displays a companys net worth through assets, liabilities, and owners equity during a defined time period (Ward, 2018).

Often, the balance sheet also includes details from previous years which allow comparisons in performance year over year. Additionally, the balance sheet assists owners and managers in planning so that financial obligations are met and credit is leveraged to best enable operations (Ward, 2018). Functionally, the balance sheet is a snapshot of a specific period, capturing all assets and debts, useful for determining convertible assets to cash, or liquidity, and the ability to use borrowed funds to produce profits, or financial leverage, of a company (Woodruff, 2018).

Proficient in: Economics

“ Have been using her for a while and please believe when I tell you, she never fail. Thanks Writer Lyla you are indeed awesome ”

Also known as the profit and loss statement, the income statement demonstrates the net revenues and expenses of a specific time period. Since all companies exist to make a profit, the income statement is particularly useful for stakeholders to determine how well the company reached this goal. Managers and owners utilize the income statement to decide if objectives are being met or whether a change in course is needed to increase profits. Stakeholders can determine the financial health of a company by analyzing operating expenses, sales, and gross profit, which measures labor productivity and efficiency of materials consumptions (Woodruff, 2018).

Wal-Mart Financial Statements

Financial statements typically list data in the millions unless otherwise noted. Financial ratios establish the relationship between the revenue and expenses on the income statement to the assets, liabilities, and equity described on the balance sheet. From the balance sheet, the stakeholders can determine a companys liquidity using such measures as current and quick ratios. On the income statement, stakeholders can determine revenue, profits, and margins. During the fiscal year 2015, Wal-Marts balance sheet showed a net income of $16,363 which showed a slight increase from 2014 ($16,022) but did not exceed figures for 2013 ($16,099) and is indicative of the profitability of the company (Wal-Mart Annual Reports, 2015). This figure is calculated by subtracting expenses from total revenues.

Financial Ratios

One of the ways to translate financial statements into meaningful data is through financial ratios which convert the raw data of line items on the statements into measures that relate the data and present information on performance. Liquidity, solvency, and equity ratios help to present a fuller picture of the financial health of the company, long-term trends, and problem areas. Different stakeholders may value different ratios based on the financial information they deem most desirable.

Current Ratio

The current ratio is a solvency ratio, measuring liquidity and efficiency by demonstrating the companys ability to pay off short-term liabilities, or those debts owed within the next year, by utilizing their current assets. GAAP require current and long-term liabilities to be entered separately on the balance sheet. Since the ratio measures current debt in terms of current assets, it is often expressed in the number of times a company can cover its obligations. For example, a current ratio of 4 means a company can cover its current obligations 4 times through its current assets. Typically, a higher current ratio is better because a company that has to used fixed assets to cover debt probably isnt making enough from its operations.

Inventory Turnover Ratio

With the inventory turnover ratio, stakeholders can determine how well inventory is managed compared to the cost of goods sold. If inventory cannot be sold, it is worthless to the company. Creditors are often interested in this ratio because inventory is used as collateral.

Receivables Turnover Ratio

With this liquidity ratio, the number of times receivables are turned over during the period is measured. In order to calculate average receivables, the amount of receivables at the beginning and end of the period are added and divided by 2. Typically, this ratio is compared to the industry standard, with a higher ratio indicating the company collects more efficiently.

Return on Assets Ratio

As another profitability ratio, the return on assets measures how a company manages it assets to generate profits. Return on assets (ROA) is a measures the profit generated by each dollar invested in assets (Ross, Westerfield, Jaffe, & Jordan, 2016, p. 49). If prior year total assets are available, average total assets can be utilized in this calculation to control for asset fluctuation.

Profit Margin (Net Margin) Ratio

This ratio is a profitability ratio measuring net income earned per each dollar of sales. Both creditors and investors are interested in how well the company converts sales into net income. While investors want sales to be high enough to pay out dividends, creditors look for sales to generate enough income to cover debts.

Debt Equity Ratio

This ratio is a liquidity ratio demonstrating the percentage of financing from creditors and investors. If this ratio is high, the company is using more bank loans than shareholder financing. A debt equity ratio of one shows the financing equally split, but a lower ratio generally indicates more stability financially.

Quick Ratio

Another solvency ratio, the quick ratio, measures the ability to pay current liabilities with quick assets, or those assets which can be converted to cash within 90 days (Ross et al., 2015). This financial acid test shows how quickly a company can turns assets into cash to pay its obligations. A higher quick ratio is usually better for the company.

Total Assets Turnover Ratio

In this ratio, sales are compared with the total assets of a company. One of the most useful ways to interpret this ratio involves plotting it on a trend line to easily spot changes over time. Industries that are more capital-intensive find this ratio more useful because higher turnover doesnt always mean higher profits, especially for service industries. Additionally, accumulated depreciation is included in this measurement and can skew results.

Financial statements provide key information concerning a companys overall financial health. Investors, managers, creditors, lenders, employees, and regulators examine these statements closely. Through the use of financial ratios, the relationships between key line items on financial statements, such as the balance sheet and income statement, can be diagnosed and evaluated. These evaluations help stakeholders make informed decisions and measure the success of a company in obtaining its number one objective, profitability.

- Ross, S., Westerfield R., Jaffe J., & Jordan B. (2015). Corporate Finance, 11th Edition. [VitalBook file]. New York, NY: McGraw-Hill Learning Solutions.

- Wal-Mart Annual Report [PDF]. (2015). Retrieved from

- Ward, S. (2018, December 18). Balance Sheet Definitions and Examples. Retrieved from

- Woodruff, J. (2018, October 22). The Purpose of a Balance Sheet & Income Statement. Retrieved from

Cite this page

Financial Ratios Analysis. (2019, Dec 16). Retrieved from https://paperap.com/financial-ratios-analysis/

"Financial Ratios Analysis." PaperAp.com , 16 Dec 2019, https://paperap.com/financial-ratios-analysis/

PaperAp.com. (2019). Financial Ratios Analysis . [Online]. Available at: https://paperap.com/financial-ratios-analysis/ [Accessed: 9 Sep. 2024]

"Financial Ratios Analysis." PaperAp.com, Dec 16, 2019. Accessed September 9, 2024. https://paperap.com/financial-ratios-analysis/

"Financial Ratios Analysis," PaperAp.com , 16-Dec-2019. [Online]. Available: https://paperap.com/financial-ratios-analysis/. [Accessed: 9-Sep-2024]

PaperAp.com. (2019). Financial Ratios Analysis . [Online]. Available at: https://paperap.com/financial-ratios-analysis/ [Accessed: 9-Sep-2024]

- Balance Sheet Counting: An Analysis of Financial Ratios Used by a Financial Analyst Pages: 4 (1103 words)

- Lowes Financial Ratios Pages: 6 (1578 words)

- Pharmaceutical Industry Average Financial Ratios 2018 Pages: 7 (1901 words)

- CFA Level 2 - Financial Reporting and Analysis Session 7 - Reading 27 Evaluating Financial Reporting Quality-LOS b Pages: 2 (417 words)

- Financial Statement Analysis Pages: 9 (2435 words)

- Tesla Motors Financial Analysis Essay Pages: 9 (2402 words)

- Financial Analysis of Google Pages: 8 (2195 words)

- Britvic Plc Financial Analysis Pages: 12 (3366 words)

- Financial Analysis Of Microsoft Corporation Pages: 2 (387 words)

- Financial Performance Analysis Pages: 1 (284 words)

Ruchira Papers Ratios and Metrics

| Current | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 | 2019 - 2015 | |

|---|---|---|---|---|---|---|---|

| Sep '24 Sep 6, 2024 | Mar '24 Mar 31, 2024 | Mar '23 Mar 31, 2023 | Mar '22 Mar 31, 2022 | Mar '21 Mar 31, 2021 | Mar '20 Mar 31, 2020 | 2019 - 2015 | |

| 4,219 | 3,341 | 2,785 | 2,902 | 1,505 | 831 | ||

| 4,654 | 3,617 | 3,275 | 3,520 | 2,153 | 1,451 | ||

| 141.35 | 111.95 | 90.19 | 99.82 | 53.11 | 29.32 | ||

| 10.00 | 6.79 | 3.98 | 8.52 | 28.37 | 2.86 | ||

| 0.65 | 0.51 | 0.35 | 0.47 | 0.36 | 0.17 | ||

| 1.02 | 0.81 | 0.73 | 0.94 | 0.56 | 0.31 | ||

| - | 25.70 | 11.52 | 36.81 | -28.31 | 4.47 | ||

| - | 8.10 | 4.50 | 8.30 | 4.42 | 2.17 | ||

| 0.71 | 0.55 | 0.41 | 0.57 | 0.52 | 0.30 | ||

| 6.30 | 4.42 | 3.00 | 5.53 | 8.77 | 3.28 | ||

| 7.86 | 5.40 | 3.49 | 7.15 | 20.00 | 4.75 | ||

| - | 27.82 | 13.55 | 44.64 | -40.51 | 7.80 | ||

| 0.11 | 0.11 | 0.11 | 0.21 | 0.28 | 0.26 | ||

| 0.60 | 0.54 | 0.38 | 1.04 | 3.10 | 1.53 | ||

| - | 3.41 | 1.73 | 8.41 | -14.34 | 3.64 | ||

| - | 1.25 | 1.66 | 1.40 | 1.02 | 1.18 | ||

| - | 5.42 | 6.34 | 5.26 | 3.88 | 4.07 | ||

| - | 1.00 | 0.94 | 0.68 | 0.70 | 0.67 | ||

| - | 2.83 | 2.31 | 1.77 | 1.58 | 1.68 | ||

| - | 12.38% | 19.60% | 11.42% | 1.87% | 10.76% | ||

| - | 7.98% | 12.13% | 7.04% | 1.65% | 4.70% | ||

| 8.40% | 9.50% | 14.71% | 8.52% | 1.98% | 5.86% | ||

| 10.00% | 14.72% | 24.29% | 11.40% | 3.32% | 32.96% | ||

| 3.89% | 8.68% | 2.72% | -3.53% | 22.39% | |||

| 3.54% | 4.47% | 5.54% | 1.82% | 1.71% | - | ||

| 0.00% | 30.33% | 8.02% | 7.33% | - | 19.93% | ||

| 0.87% | -0.02% | -5.68% | -5.86% | - | -5.04% | ||

| 4.41% | 4.45% | -0.14% | -4.04% | 1.71% | -5.04% |

IMAGES

VIDEO

COMMENTS

Remember! This is just a sample. You can get your custom paper by one of our expert writers. Get custom essay. = 1,000,000/300,000. = 3:1. The ratio is higher showing that the company's security on loans is stable. This acts as assurance to lenders hence the company is capable of withstanding long-term loans.

Financial Ratio Analysis: Definition, Types, Examples, and ...

Complete List and Guide to All Financial Ratios

Financial Ratio Analysis Tutorial With Examples

(PDF) Financial Ratio Analysis: A Theoretical Study

Financial statements are useful as they can be used to predict future indicators for a firm using the financial ratio analysis. From an investor's perspective financial statement analysis aims at predicting the future profitability and viability of a company, while from the management's point of view the ratio analysis is important as it helps anticipate the future conditions in which the ...

Some important leverage ratios are: Debt-to-Equity Ratio: This is calculated as total debt / total equity. A higher ratio indicates higher financial risk due to a higher proportion of debt. Debt Ratio: This shows the proportion of a company's assets financed by debt and is calculated as total debt / total assets.

Financial ratio analysis compares relationships between financial statement accounts to identify the strengths and weaknesses of a company. Financial ratios are usually split into seven main categories: liquidity, solvency, efficiency, profitability, equity, market prospects, investment leverage, and coverage.

6 Basic Financial Ratios and What They Reveal

1. Comparisons. One of the uses of ratio analysis is to compare a company's financial performance to similar firms in the industry to understand the company's position in the market. Obtaining financial ratios, such as Price/Earnings, from known competitors and comparing them to the company's ratios can help management identify market ...

Essay on Financial Ratios

Sample Companies' Profitability Ratios ROI for Sample CO. is $350 / $7,196 = 4.8% using net income. If operating Income is used we have $498 / $7,196 = 6.9%. An additional measure used for ROI is the DuPont Model. The DuPont model figures are ($498 / $8,251) * ($8,251 / $7,196) = 6.0% using operating income. These are somewhat low when compared ...

What Are Financial Ratios & Why Important?

What Is Financial Ratio Analysis?

Essay # 1. Meaning of Financial Ratios: Financial ratios express relationship between two financial variables. For example, sales is one element of profit and loss account and profit after tax (PAT) is another element. Financial ratio are either expressed in number or in percentage. ADVERTISEMENTS:

Financial Ratios Analysis Essays. Unleashing the Power of Amazon Stock: A Promising Investment Opportunity. Introduction Amazon (AMZN) has been a global powerhouse since its 1997 IPO. E-commerce, cloud computing, and digital streaming drive Amazon's prosperity. Amazon investors must understand its volatility and market factors.

Executive Summary Ratio analysis has been one of the many options for analyzing the performance of companies. Every single investor will be interested in monitoring the potential of each unit of investment made. Using the financial statements, the report calculated eight ratios in the three standard categories profitability, liquidity, and efficiency.

Financial ratios are an essential part of financial analysis. They are used in order to ascertain financial trends within a company's structure, and they are widely preferred primarily due to their simplicity and informativity. In addition, financial ratios show variables relating to a particular industry. By using financial ratios, a company ...

Ratio and Financial Statement Analysis Essay. 2539 Words; 11 Pages; ... Financial ratio analysis is an effective tool to determine hospital's performance on several indicators such as ability to pay debt, capability to generate revenue, and sales performance etc. The objective of this paper is to describe role of different financial ratios in ...

These financial ratios can be determined or worked out from a company's income statements or operational data (Casado, 2006, p.103). For the 310-room hotel in Costa Mesa, California, the Occupancy percentage is 7,755: 310 = 25.02%. Cost of labor percentage for rooms is 103,202: 437,433 = 23% for F&B is 113,349: 302,188 = 37.5%.

Essay Sample: All of the stakeholders in a business will be interested in analyzing financial statements and the accompanying financial ratios derived from those. ... Financial ratios establish the relationship between the revenue and expenses on the income statement to the assets, liabilities, and equity described on the balance sheet. ...

The ROA ratio is calculated by taking the net earnings available to common stockholders (net income) and dividing it by total assets. This ratio is used to determine the amount of income each dollar of assets generates. Example: an ROA ratio of 0.0568 indicates that each dollar of company assets produced income of almost $0.06.

Financial ratios and metrics for Ruchira Papers (NSE: RUCHIRA). Includes annual, quarterly and trailing numbers with full history and charts. ... Ruchira Papers Ratios and Metrics. Market cap in millions INR. Fiscal year is April - March. Millions INR. Fiscal year is Apr - Mar. Current. Millions. Data Source. Export. Fiscal Year. Current FY 2024

Financial ratios 1. Current ratio Current ratio=Current Assets/Current Liabilities 18,720 / 17,089=1.0954 2. Quick ratio Quick ratio= (Current Assets - Inventories) / Current Liabilities (18,720 - 3,581)/17,089=0.8859 3. Return on Assets ratio Return on Assets ratio= Net Profit before Tax/Total Assets 34,201/74,638=0.4582 4.