Penn Libraries FAQ

- Penn Libraries

Q. How do I find analyst reports (investment bank research)?

- Exhibitions

- Fisher Fine Arts

- General Information

- Phased Library Services

- Rare Books & Special Collections

- Systematic Reviews

- University Archives & Records Center

Answered By: Lippincott Library Last Updated: Apr 21, 2024 Views: 183046

Use LSEG Workspace (formerly Refinitiv).

- To find analyst reports (also known as sell-side, broker, or equity research reports) for a specific company, search for that firm's ticker symbol or name in the top search box. Then, on the News & Research menu, click on Company Research . Use filters near the top of the page to refine your search.

- To screen for analyst reports based on a set of criteria, type ADVRES in the search bar and select the Research Advanced Search app, or click on Research in the main menu. then, click on Advanced Research . You can filter for reports by industry, geography, contributor, keywords, and more.

Note: LSEG Workspace has a 150-page daily limit for viewing and downloading research content. This limit is in lieu of retail prices listed on reports and resets at 12:00 AM Eastern Time daily.

Bloomberg (see access details ) contains some analyst reports.

- Type your company's ticker symbol, then hit the yellow EQUITY key, then type DSCO and hit the green GO key.

- To find reports by industry or keyword, type RES and hit the green GO key.

Morningstar equity research reports and analyst cash flow models can be found in PitchBook .

Hoovers contains some analyst reports as well.

- Type in a company name and select the company you want.

- Scroll down the screen; if available, analyst reports appear under Advanced on the left side.

- Share on Facebook

Was this helpful? Yes 0 No 0

Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

Equity Research Reports: A Complete Guide

Equity research reports are documents prepared by equity research analysts that provide insights on whether investors should buy, hold, or sell shares of a public company. For anyone looking to stay up-to-date on market and industry trends, equity research is a crucial and differentiated asset.

In this guide, you will learn about the type of information contained in equity research, the value it offers to corporate professionals, and how the most advanced teams are already leveraging the expertise of Wall Street’s top analysts to inform critical business decisions.

Introduction

Equity research, which forms a multi-billion dollar industry for investment banks, is produced by thousands of analysts worldwide to provide the market with valuable information on companies, industries, and market trends. Today, over 90% of equity research is consumed by fund managers, who have the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For corporate strategy professionals who lack this access, however, equity research has historically been challenging to obtain and navigate.

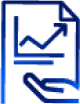

To help corporations circumvent these challenges, AlphaSense has introduced Wall Street Insights, the first and only equity research collection purpose-built for the corporate user. Through the AlphaSense platform, any business making strategic plans or product decisions, conducting competitive analysis, evaluating M&A, or engaging in investor relations can now tap into the deep industry expertise of Wall Street’s top analysts.

What is Equity Research?

Equity research is developed by sell-side firms to help investors and hedge fund managers discover market opportunities and make informed investment decisions. Increasingly, this expert analysis has also been identified by forward-looking corporations as a highly valuable tool to inform strategic decision-making.

There are thousands of sell-side firms that employ expert analysts around the globe to write equity research for the market. The majority of firms producing equity research are hyper-focused and only have one or two analysts developing reports on a specific industry. However, larger firms, such as Morgan Stanley and Bank of America, collectively employ thousands of analysts to write reports on thousands of public companies–covering everything from TMT giants to niche products.

Equity research analysts are deep subject matter experts who are often former executives, industry veterans, or academics. These analysts conduct in-depth research and publish reports on corporations, industries, and macro trends, offering an expert lens into a subject.

Historically, over 90% of equity research was consumed by buy-side fund managers, who had the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For buy-side professionals, equity research is a critical tool to inform sound investment decisions backed by expert insights.

Today, equity research is increasingly relied upon by corporate teams as a high-value source of information. These teams leverage equity research to make strategic business plans, conduct competitive analysis, evaluate mergers and acquisitions, and make product and marketing decisions. For corporations, the value of equity research lies in the detailed coverage of their company, their competitors, and how they are performing related to the marketplace they are within.

What is an Equity Research Report?

An equity research report is a document prepared by an equity research analyst that often provides insight on whether investors should buy, hold, or sell shares of a public company. In an equity research report, an analyst lays out their recommendation, target price, investment thesis, valuation, and risks.

There are multiple forms of equity research, including (but not limited to):

An update report that highlights the latest news, company announcements, earnings reports, Buy Sell Hold ratings, M&A activity, anything that impacts the value of the company.

A comprehensive company report that is compiled when an analyst or firm initiates their coverage of a stock. Initiation reports cover all of the divisions and products of a company in-depth to provide a baseline of what the company is and how it is performing. Initiation reports can be tens to hundreds of pages long, depending on the complexity of a company.

General industry updates that cover a group of similar companies within a sector. Industry-specific reports typically dive into additional factors such as loan growth, interest rates, interest income, net income, and regulatory capital.

A report compiled by research firms either daily or weekly. These reports can often be a great place to get more in-depth insight on commodities and also get market opinions from commodity analysts or traders who write the reports.

A quick 1-2 page report that comments on a news release from a company or other quick information

What is Included in a Typical Equity Research Report?

Research reports don’t need to follow a specific formula. Analysts at different investment banks have some latitude in determining the look and feel of their reports. But more often than not, research reports follow a certain protocol of what investors expect them to look like.

A typical equity research report includes in-depth industry research, management analysis, financial histories, trends, forecasting, valuations, and recommendations for investors. Sometimes called broker research reports or investment research reports, equity research reports are designed to provide a comprehensive snapshot that investors or corporate leaders can leverage to make informed decisions.

Here’s a quick overview of what a standard equity research report covers:

This section covers events, such as quarterly results, guidance, and general company updates.

Upgrades/Downgrades are positive or negative changes in an analyst’s outlook of a particular stock valuation. These updates are usually triggered by qualitative and quantitative analysis that contributes to an increase or decrease in the financial valuation of that security.

Estimates are detailed projections of what a company will earn over the next several years. Valuations of those earnings estimates form price targets. The price target is based on assumptions about the asset’s future supply & demand and fundamentals.

Management Overview and Commentary helps potential investors understand the quality and makeup of a company’s management team. This section can also include a history of leadership within the company and their record with capital allocation, ESG, compensation, incentives, stock ownership. Plus, an overview of the company’s board of directors.

This section covers competitors, industry trends, and a company’s standing among its sector. Industry research includes everything from politics to economics, social trends, technological innovation, and more.

Historical Financial Results typically cover the history of a company’s stock, plus expectations based on the current market and events surrounding it. To determine if a company is at or above market expectations, Analysts must deeply understand the history of a specific industry and find patterns or trends to support their recommendations.

Based on the market analysis, historical financial results, etc., an analyst will run equity valuation models. In some cases, analysts will run more than one valuation model to determine the worth of company stock or asset.

Absolute valuation models : calculates a company’s or asset’s inherent value.

Relative equity valuation models : calculates a company’s or asset’s value relative to another company or asset. Relative valuations base their numbers on price/sales, price/earnings, price/cash flow.

An equity research analyst’s recommendation to buy, hold, or sell. The analyst also will have a target price that tells investors where they expect the stock to be in a year’s time.

Related Reading: Best Stock and Investment Research Tools (Buyer’s Guide)

What Does an Equity Research Analyst Do?

Equity research analysts exist on both the buy-side and the sell-side of the financial services market. Although these roles differ, both buy-side and sell-side analysts produce reports, projections, and recommendations for specific companies and stocks.

An equity research analyst specializes in a group of companies in a particular industry or country to develop high-level expertise and produce accurate projects and recommendations. Since ER analysts generally focus on a small set of stocks (5-20), they become specialists in those specific companies and industries that they evaluate or follow. These analysts monitor market data and news reports and speak to contacts within the companies/industries they study to update their research daily.

Analysts need to comprehend everything about their ‘coverage’ to give investment endorsements. Equity research analysts must be conversant with the business regulations and regime policies within the country to decide how it will affect the market environment and business in general. The more you understand the industries in detail, the easier it will be for you to decipher market dynamics.

One prevalent aspect of an equity research analyst’s job is building and maintaining valuable relationships with corporate leaders, clients, and peers. Equity research is largely about an analyst’s ability to service clients and provide insightful ideas that positively influence their investing strategy.

EQUITY RESEARCH ANALYSTS:

- Analyze stocks to help portfolio managers make better-informed investment decisions.

- Analyze a stock against market activity to predict a stock’s outlook.

- Develop investment models and provide trading strategies.

- Provide expertise on markets and industries based on their competitive analysis, business analysis, and market research.

- Use data to model and measure the financial risk associated with particular investment decisions.

- Understand the details of various markets to compare a company’s and sector’s stock

Buy-Side vs. Sell-Side Analysts

Although the roles of buy-side and sell-side analysts do overlap in some respects, the purpose of their research differs.

Related Reading: Sell-Side vs Buy-Side Research: Comparison Guide

How Can Corporate Teams Access Equity Research?

If you were to Google “equity research reports,” you would not get access to equity research, earnings call transcripts or trade journals. You would, however, discover an unmanageable amount of noise to sift through.

Accessing equity research reports is highly dependent on relationships and entitlements, particularly for corporate teams. Unlike financial firms and investor relations teams, who can access equity research by procuring the right entitlements, corporate teams have a much harder time finding and purchasing high-quality equity research.

If you were to search online for equity research, for example, you would be presented with sub-par options such as:

Some websites allow you to search for research reports on companies or by firms. Some of the reports are free, but you must pay for most of them. Prices range from just $15 to thousands of dollars.

If you want just the bottom-line recommendations from analysts, many sites summarize the data. Nearly all the websites that provide stock quotes also compile analyst recommendations, however, you will only get the big picture and not any of the detailed analysis.

Some independent research providers sell their reports directly to investors. These reports typically include an overview of what a stock’s price could be, plus an analysis of the company’s earnings. These reports often cost less than $100 but can be more.

The majority of equity research is completely unsearchable, which is why AlphaSense’s Wall Street Insights is changing the game for corporations globally. Now, with WSI, corporations can leverage this high-quality research to augment their understanding of specific companies and industries; plus, AlphaSense’s corporate clients can now conduct more meaningful analysis and make more data-driven decisions.

Real-Time Research : Real-Time research is available to eligible users (based on an entitlement) immediately upon publication by the broker. Financial Services users with entitlements are the primary consumers of real-time research, while some Corporate professionals are also eligible. Payment for real-time research is made directly from clients to brokers through trading commissions or hard dollar agreements.

Aftermarket Research : Aftermarket research is a collection of many of the same documents as the real-time collection, but it is available after a zero to fifteen-day delay. Investment bankers, consultants, and corporate users are the primary consumers of Aftermarket research.

What is Wall Street Insights (WSI)?

Wall Street Insights® is the first and only equity research collection purpose-built for the corporate market, providing corporations unprecedented access to a deep pool of equity research reports from thousands of expert analysts.

Through partnerships with Morgan Stanley, Bank of America, Barclays, Bernstein, Bernstein Autonomous, Cowen, Deutsche Bank, Evercore ISI, HSBC, and others, corporate professionals can now access the world’s most revered equity research, indexed and searchable in the AlphaSense platform.

From macro market trends and industry analyses to company deep-dives, the Wall Street Insights® content collection provides corporate professionals with a 360-degree view of every market. With the valuable expertise of thousands of analysts on your side, corporate teams can quickly compare insights, validate internal assumptions, and generate new ideas to guide critical business decisions and strategies.

In terms of search and accessibility, Wall Street Insights® is the first of its kind. Not only does AlphaSense offer hard-to-find equity research reports, but we also provide a robust and seamless search experience.

What Equity Research Do You Get Access to with AlphaSense?

On the AlphaSense platform, users can access several critical types of equity research reports, including:

- Upgrades/downgrades: published when a stock analyst changes their opinion of a stock, and subsequently, their investment recommendation

- Estimate / price target revisions: published when an analyst revises their previous price target (their prediction of the future price of a security)

- Initiation reports: published when a broker first begins covering a company

- Credit research

- All other company reports

- Industry reports – Analyze a set of companies within the same industry

- Fixed income reports – Demonstrate maturity distribution of portfolios

- Economic/macro reports – Shares analysts’ views on growth expectations, inflation, stock market volatility, and global market trade

- Commodities reports – Provide analysis of commodities within a particular industry, published weekly or monthly

Related Reading: 7 Things You Miss By Only Using Bloomberg for Investment Research

Using these reports, companies can perform the following key strategic tasks:

- Create investment ideas

- Monitor peers in real-time (and discover what equity research is being produced about them)

- Model and evaluate companies (for M&A or general benchmarking)

- Dive deep into customers, partners, and prospects

- Get up-to-speed quickly on specific industry trends

- Prepare for earnings season

Unlock More Value From Equity Research With Artificial Intelligence and Automation

When you rely on an equity research platform that utilizes the power of AI search technology, you can be more confident in your research, knowing you are no longer at the mercy of human error. AlphaSense also allows you to automate certain research processes that previously would have required hours of manual work, streamlining your entire process so you can take action and make mission-critical decisions faster than ever.

Here’s how our semantic search and smart automations can transform your workflow:

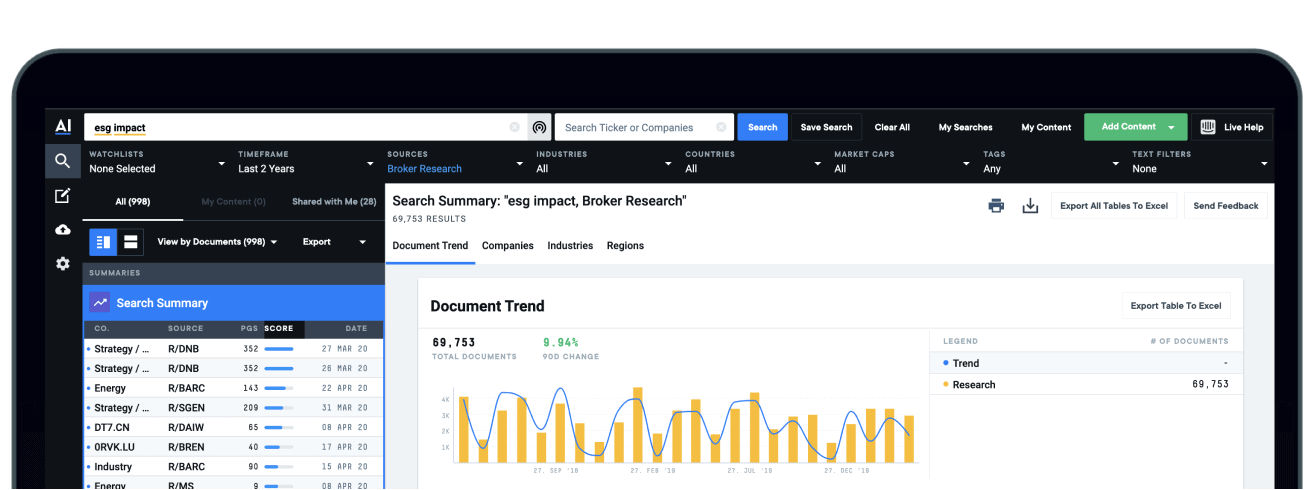

Smart Search

Smart Search technology doesn’t just recognize the keywords included in your query—it understands the intent behind your search, delivering content sources with the highest relevance and value to your search. It allows you to find all relevant data points with a single search, saving countless hours and increasing precision in your research.

Additionally, broker research is often inconsistently tagged because different firms may use different classification taxonomies, or include their own terms to define industries and trends. In addition to recognizing relevant language patterns, Smart Search assigns correct tagging to reports from thousands of analysts and research firms, regardless of which analyst published the report.

Smart Synonyms™ , our proprietary element of Smart Search, weeds out the sources that may include similar keywords but are not topically significant to your research, meaning you’ll never have to cut through excess noise to find the insights you need.

Relevance Rankings

AlphaSense automatically ranks results by their relevance to your research using a number of algorithmic factors, including search term proximity, Smart Synonyms™ , and document decay. You can be confident that the content sources at the top of your search results page are the ones most aligned with your current research needs.

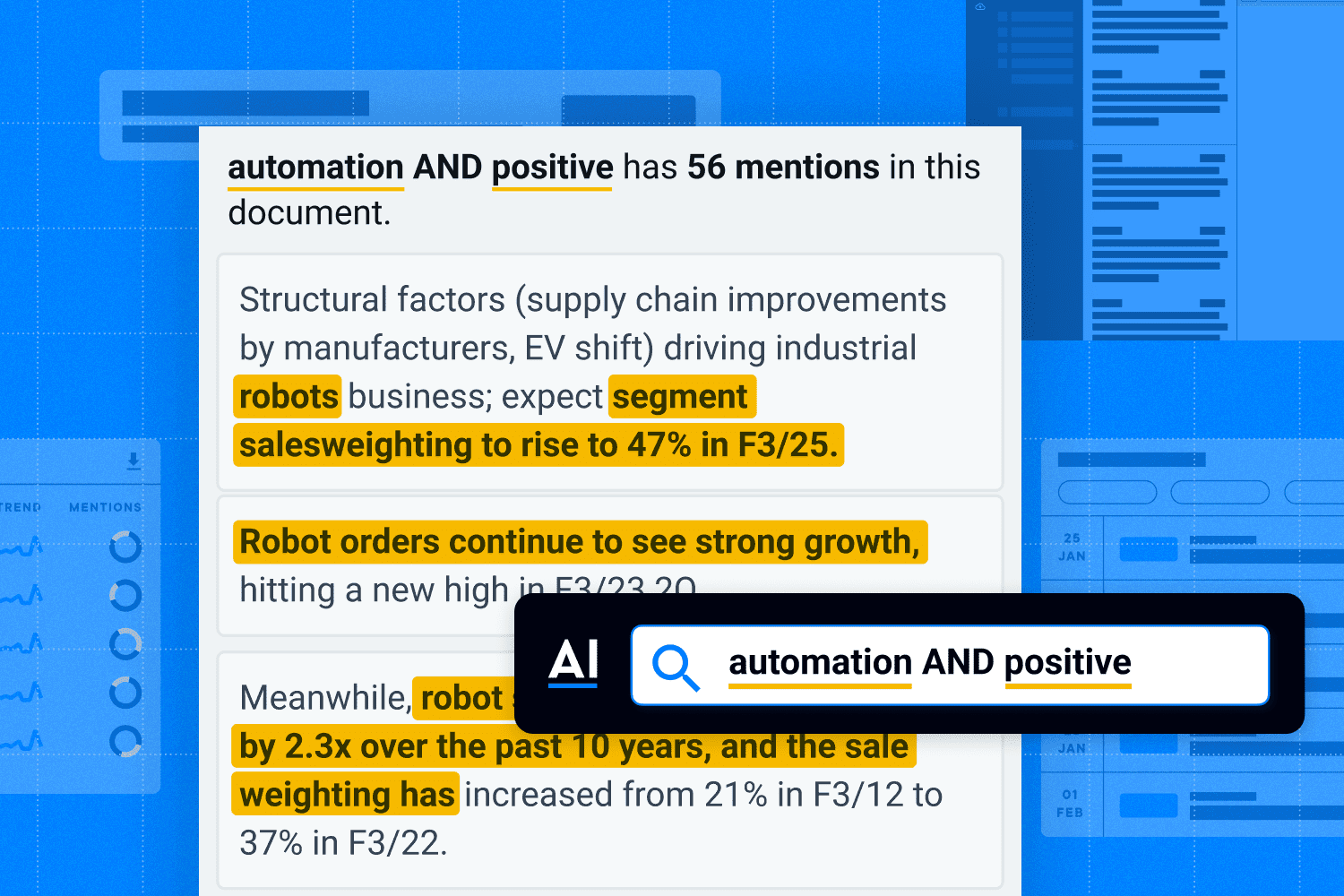

Real-Time Monitoring

Without a centralized search system, analysts are left to perform multiple manual searches and parse through Google Alerts for the ones with real relevance. On the AlphaSense platform, real-time alerts are customizable and can be set up for a particular company, industry, keyword, or topic (or a set/list of any of the above).

Additionally, you can easily set up customizable dashboards and watchlists to monitor the industries, topics, and companies of interest to you and ensure that you receive instant notifications of any pertinent updates—without getting bogged down by alerts that are not relevant to your research.

Smart Summaries

AlphaSense’s generative AI is purpose-built for business professionals, leaning on 10+ years of AI tech development. Our proprietary genAI tool, Smart Summaries , generates insights across all four key perspectives—company documents, news, expert calls, and broker research.

Sourced from across all broker research you are entitled to, published within the past 90 days, Smart Summaries covers sections including:

- Upgrades and downgrades – Covers which brokers have upgraded/downgraded this company within the past 90 days and why

- SWOT analysis – Covers the topics/trends identified as strengths/opportunities or threats/weaknesses from across broker reports about this company

- Competitive landscape – Covers the competitive landscape for this company from across broker reports

Generative Search

Our generative AI chat experience transforms how users can extract insights from hundreds of millions of premium content sources. Our chatbot is trained to think like an analyst, so it understands the market research intent behind your natural language queries. Whenever you search for information, our genAI is available to summarize key company events, emerging topics, and industry-wide viewpoints. You can dig deeper into topics by asking follow-up questions or choosing a suggested query.

Level Up Your Equity Research Strategy With AlphaSense

AlphaSense is the leading equity research platform for modern financial and research professionals. Trusted by 88% of the S&P 100, 80% of the top asset management firms, 95% of the top consulting companies, and 20 of the largest pharmaceutical companies, AlphaSense delivers insights that drive growth to organizations and research teams across industries and around the globe.

Providing a 360-degree view of every market—from macro trends and industry analyses to company deep-dives and individual stock valuations—AlphaSense’s Wall Street Insights® is a key component of an investment research workflow that wins.

Discover the power of equity research reports with AlphaSense today.

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in an Equity Research Report?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Even though you can easily find real equity research reports via the magical tool known as “Google,” we’ve continued to get questions on this topic.

Whenever I see the same question over and over again, you know what I do: I bash my head in repeatedly and contemplate jumping off a building…

…and then I write an article to answer the question.

To understand an equity research report, you must understand what goes into a stock pitch first.

The idea is similar, but an ER report is a “watered-down” version of a stock pitch.

But banks have some very solid reasons for publishing equity research reports:

Why Do Equity Research Reports Matter?

You might remember from previous articles that equity research teams do not spend that much time writing these reports .

Most of their time is spent speaking with management teams and institutional investors and sharing their views on sectors and companies.

However, equity research reports are still important because:

- You do still spend some time doing the required modeling work (~15%) and writing the reports (~20%).

- You might have to write a research report as part of the interview process.

For example, if you apply to an equity research role or an equity research internship , especially in an off-cycle process, you might be asked to draft a short report on a company.

And then in roles outside of ER, you need to know how to interpret reports quickly and extract the key information.

Equity Research Reports: Myth vs. Reality

If you want to understand equity research reports, you have to understand first why banks publish them: to earn higher commissions from trading activity.

A bank wants to encourage institutional investors to buy more shares of the companies it covers.

Doing so generates more trading volume and higher commissions for the bank.

This is why you rarely, if ever, see “Sell” ratings, and why “Hold” ratings are far less common than “Buy” ratings.

Different Types of Equity Research Reports

One last point before getting into the tutorial: There are many different types of research reports.

“Initiating Coverage” reports tend to be long – 50-100 pages or more – and have tons of industry research and data.

“Sector Reports” on entire industries are also very long. And there are other types, which you can read about here .

In this tutorial, we’re focusing on the “Company Update” or “Company Note”-type reports, which are the most common ones.

The Full Tutorial, Video, and Sample Equity Research Reports

For our full walk-through of equity research reports, please see the video below:

Table of Contents:

- 1:43: Part 1: Stock Pitches vs. Equity Research Reports

- 6:00: Part 2: The 4 Main Differences in Research Reports

- 12:46: Part 3: Sample Reports and the Typical Sections

- 20:53: Recap and Summary

You can get the reports and documents referenced in the video here:

- Equity Research Report – Jazz Pharmaceuticals [JAZZ] – OUTPERFORM [BUY] Recommendation [PDF]

- Equity Research Report – Shawbrook [SHAW] – NEUTRAL [HOLD] Recommendation [PDF]

- Equity Research Reports vs. Stock Pitches – Slides [PDF]

If you want the text version instead, keep reading:

Watered-Down Stock Pitches

You should think of equity research reports as “watered-down stock pitches.”

If you’ve forgotten, a hedge fund or asset management stock pitch ( sample stock pitch here ) has the following components:

- Part 1: Recommendation

- Part 2: Company Background

- Part 3: Investment Thesis

- Part 4: Catalysts

- Part 5: Valuation

- Part 6: Investment Risks and How to Mitigate Them

- Part 7: The Worst-Case Scenario and How to Avoid It

In a stock pitch, you’ll spend most of your time and energy on the Catalysts, Valuation, and Investment Risks because you want to express a VERY different view of the company .

For example, the company’s stock price is $100, but you believe it’s worth only $50 because it’s about to report earnings 80% lower than expectations.

Therefore, you recommend shorting the stock. You also recommend purchasing call options at an exercise price of $125 to limit your losses to 25% if the stock moves in the opposite direction.

In an equity research report, you’ll still express a view of the company that’s different from the consensus, but your view won’t be dramatically different.

You’ll spend more time on the Company Background and Valuation sections, and far less time and space on the Catalysts and Risk Factors. And you won’t even write a Worst-Case Scenario section.

If a company seems overvalued by 50%, a research analyst would probably write a “Hold” recommendation, say that there’s “uncertainty around several customers,” and claim that the company’s current market value is appropriate.

Oh, and by the way, one risk factor is that the company might report lower-than-expected earnings.

The Four Main Differences in Equity Research Reports

The main differences are as follows:

1) There’s More Emphasis on Recent Results and Announcements

For example, how does a recent product announcement, clinical trial result, or earnings report impact the company?

You’ll almost always see recent news and updates on the first page of a research report:

These factors may play a role in hedge fund stock pitches as well, but more so in short recommendations since timing is more important there.

2) Far-Outside-the-Mainstream Views Are Less Common

One comical example of this trend is how all 15 equity research analysts covering Enron rated it a “buy” right before it collapsed :

Sell-side analysts are far less likely to point out that the emperor has no clothes than buy-side analysts.

3) Research Reports Give “Target Prices” Rather Than Target Price Ranges

For example, the company is trading at $50.00 right now, but we expect its price to increase to exactly $75.00 in the next twelve months.

This idea is completely ridiculous because valuation is always about the range of possible outcomes, not a specific outcome.

Despite horrendously low accuracy , this practice continues.

To be fair, many analysts do give target prices in different cases, which is an improvement:

4) The Investment Thesis, Catalysts, and Risk Factors Are “Looser”

These sections tend to be “afterthoughts” in most reports.

For example, the bank might give a few reasons why it expects the company’s share price to rise: the company will capture more market share than expected, it will be able to increase its product prices more rapidly than expected, and a competitor is about to go bankrupt.

However, the sell-side analyst will not tie these factors to specific share-price impacts as a buy-side analyst would.

Similarly, the report might mention catalysts and investment risks, but there won’t be a link to a specific valuation impact from each factor.

So the typical stock pitch logic (“We think there’s a 50% chance of gaining 80% and a 50% chance of losing 20%”) won’t be spelled out explicitly:

Your Sample Equity Research Reports

To illustrate these concepts, I’m sharing two equity research reports from our financial modeling courses :

The first one is from the valuation case study in our Advanced Financial Modeling course , and the second one is from the main case study in our Bank Modeling course .

These are comprehensive examples, backed by industry data and outside research, but if you want a shorter/simpler example you can recreate in a few hours, the Core Financial Modeling course has just that.

In each case, we started by creating traditional HF/AM stock pitches and valuations and then made our views weaker in the research reports.

The Typical Sections of an Equity Research Report

So let’s briefly go through the main sections of these reports, using the two examples above:

Page 1: Update, Rating, Price Target, and Recent Results

The first page of an “Update” report states the bank’s recommendation (Buy, Hold, or Sell, sometimes with slightly different terminology), and gives recent updates on the company.

For example, in both these reports we reference recent earnings results from the companies and expectations for the next fiscal year:

We also give a “target price,” explain where it comes from, and give our estimates for the company’s key financial metrics.

We mention catalysts in both reports, but we don’t link anything to a specific valuation impact.

One problem with providing a specific “target price” is that it must be based on specific multiples and specific assumptions in a DCF or DDM.

So with Jazz, we explain that the $170.00 target is based on 20.7x and 15.3x EV/EBITDA multiples for the comps, and a discount rate of 8.07% and Terminal FCF growth rate of 0.3% in the DCF.

Next: Operations and Financial Summary

Next, you’ll see a section with lots of graphs and charts detailing the company’s financial performance, market share, and important metrics and ratios.

For a pharmaceutical company like Jazz, you might see revenue by product, pricing and # of patients per product per year, and EBITDA margins.

For a commercial bank like Shawbrook, you might see loan growth, interest rates, interest income and net income, and regulatory capital figures such as the Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) ratios:

This section of the report explains how the analyst or equity research associate forecast the company’s performance and came up with the numbers used in the valuation.

The valuation section is the one that’s most similar in a research report and a stock pitch.

In both fields, you explain how you arrived at the company’s implied value, which usually involves pasting in a DCF or DDM analysis and comparable companies and transactions.

The methodologies are the same, but the assumptions might differ substantially.

In research, you’re also more likely to point to specific multiples, such as the 75 th percentile EV/EBITDA multiple, and explain why they are the most meaningful ones.

For example, you might argue that since the company’s growth rates and margins exceed the medians of the set, it deserves to be valued at the 75 th percentile multiples rather than the median multiples:

Investment Thesis, Catalysts, and Risks

This section is short, and it is more of an afterthought than anything else.

We do give reasons for why these companies might be mis-priced, but the reasoning isn’t that detailed.

For example, in the Shawbrook report we state that the U.K. mortgage market might slow down and that regulatory changes might reduce the market size and the company’s market share:

Those are legitimate catalysts, but the report doesn’t explain their share-price impact in the same way that a stock pitch would.

Finally, banks present Investment Risks mostly so they can say, “Well, we warned you there were risks and that our recommendation might be wrong.”

By contrast, buy-side analysts present Investment Risks so they can say, “There is a legitimate chance we could lose 50% – let’s hedge against that risk with options or other investments so that our fund does not collapse .”

How These Reports Both Differ from the Corresponding Stock Pitches

The Jazz equity research report corresponds to a “Long” pitch that’s much stronger:

- We estimate its intrinsic value as $180 – $220 / share , up from $170 in the report.

- We estimate the per-share impact of each catalyst: price increases add 15% to the share price, more patients from marketing efforts add 10%, and later-than-expected generics competition adds 15%.

- We also estimate the per-share impact from the risk factors and conclude that in the worst case , the company’s share price might decline from $130 to $75-$80. But in all likelihood, even if we’re wrong, the company is simply valued appropriately at $130.

- And then we explain how to hedge against these risks with put options.

The same differences apply to the Shawbrook research report vs. the stock pitch, but the stock pitch there is a “Short” recommendation where we claim that the company is overvalued by 30-50%.

And that sums up the differences perfectly: A Short recommendation with 30-50% downside in a stock pitch turns into a “Hold” recommendation with roughly equal upside and downside in a sell-side research report.

I’ve been harsh on equity research here, but I don’t want to disparage it too much.

There are many positives: You do get more creativity than in IB, it might be better for hedge fund or asset management exits, and it’s more fun to follow companies than to grind through grunt work on deals.

But no matter how you slice it, most equity research reports are watered-down stock pitches.

So, make sure you understand the “strong stuff” first before you downgrade – even if your long-term goal is equity research.

You might be interested in:

- The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

- Private Equity Regulation : 2023 Changes and Impact on Finance Careers

- Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

15 thoughts on “ What’s in an Equity Research Report? ”

Hi Brian, what softwares are available to publish Research Reports?

We use Word templates. Some large banks have specialized/custom programs, but not sure how common they are.

Is it possible if you can send me a template in word of an equity report? It will help the graduate stock management fund a lot at Umass Boston.

We only have PDF versions for these, but Word should be able to open any PDF reasonably well.

Do you also provide a pre constructed version of an ER in word?

We have editable examples of equity research reports in Word, but we generally only share PDF versions on this site.

Hey Brian Can you please help me with coverage initiated reports on oil companies. I could not find them on the net. I need to them to get equity research experience, after which only I will be able to get into the field. I searched but reports could not be found even for a price. Thanks

We have an example of an oil & gas stock pitch on this site… do a search…

https://mergersandinquisitions.com/oil-gas-stock-pitch/

Beyond that, sorry, we cannot look for reports and then share them with you or we’d be inundated with requests to do that every day.

No worries. Thanks!

Hi! Brian! Do u know how investment bankers design and layout an equity research? the software they use. like MS Word, Adobe Indesign or something…? And how to create and layout one? Thanks

where can I get free equity research report? I am a Chinese student and now study in Australia. Is the Morning Star a good resource for research report?

Get a TD Ameritrade to access free reports there for certain companies.

How do you view the ER industry since the trading commission has been down 50% since 2007. And there are new in coming regulation governing the ER reports have to explicitly priced and funds need to pay for the report explicity rather than as a service comes free with brokerage?

In addition the whole S&T environment is becoming highly automated.

People have been predicting the death of equity research for over a decade, but it’s still here. It may not be around in 100 years, but it will still be around in another 10 years, though it will be smaller and less relevant.

Yes, things are becoming more automated, but the actual job of an equity research analyst or associate hasn’t changed dramatically. A machine can’t speak with investors to assess their sentiment on a company – only humans can do that.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

Standard & Poor's Capital IQ: Research Reports

- Venture Capital

- Research Reports

- Company Filings

- Idea Generation

- Merger Types

- CFRA's The Outlook

- Business Relationships (Supply Chain)

- Capital Debt Structure

- Financials Glossary

- Industry Surveys

Research Reports on Capital IQ

Using Capital IQ, you can search for analysts' research reports on public companies, mutual funds and industries.

From your dashboard, or any other screen on Capital IQ, place your cursor over the tab titled Research , on the horizontal row of tabs near the top of the page. From there, type in the name or symbol of a company or mutual fund in the search box. Add other criteria as needed. Then press the Search button. The results for company searches may include industry reports as well as company reports. Please note - only research reports published by firms associated with Standard and Poor's, such as CFRA, are available through our Capital IQ subscription. Others are only available in brief summaries.

To search for the latest reports by a specific analyst or firm, leave the Name/Symbol box empty, and select a name from the drop-down menu under Contributors . Next, press the Search button.

CFRA Industry Surveys

To access CFRA's latest industry surveys, select the Industry Surveys tab from the ribbon near the top of the screen.

- << Previous: Venture Capital

- Next: Screening >>

- Last Updated: Oct 2, 2024 2:04 PM

- URL: https://libguides.nypl.org/CapitalIQ

IMAGES

VIDEO

COMMENTS

To find analyst reports (also known as sell-side, broker, or equity research reports) for a specific company, search for that firm's ticker symbol or name in the top search box. Then, on the News & Research menu, click on Company Research. Use filters near the top of the page to refine your search.

Equity research reports are documents prepared by equity research analysts that provide insights on whether investors should buy, hold, or sell shares of a public company. For anyone looking to stay up-to-date on market and industry trends, equity research is a crucial and differentiated asset.

To understand an equity research report, you must understand what goes into a stock pitch first. The idea is similar, but an ER report is a “watered-down” version of a stock pitch. But banks have some very solid reasons for publishing equity research reports: Why Do Equity Research Reports Matter?

An equity research report is a document prepared by an analyst that provides a recommendation for investors to buy, hold, or sell shares of a company.

EQUITY RESEARCH REPORT ESSENTIALS. An equity research report can include varying levels of detail, and although there is no industry standard when it comes to format, there are common elements to all thorough and effective equity research reports.

From your dashboard, or any other screen on Capital IQ, place your cursor over the tab titled Research, on the horizontal row of tabs near the top of the page. From there, type in the name or symbol of a company or mutual fund in the search box. Add other criteria as needed. Then press the Search button.